In our last blog publication, two put applications were discussed: traditional put-selling and the PCP (wheel) Strategy. In this week’s article, three more approaches will be reviewed, states Alan Ellman of The Blue Collar Investor.

Selling Cash-Secured Puts: Part II Methodologies

- Buying a stock at a discount

- Ultra-low-risk strategies

- Delta

- Implied volatility (IV)

Buying a Stock at a Discount: A Real-Life Example with Micron Tecnology, Inc. (MU)

The trade

- 2/21/2022: MU trading at $90.10

- MU is an eligible stock on our premium stock watch list

- No upcoming ER for the contracts expiring on 3/18/2022

- Set a limit order to buy at about $83.00 (example goal)

- Sell a CSP with breakeven at about $83.00

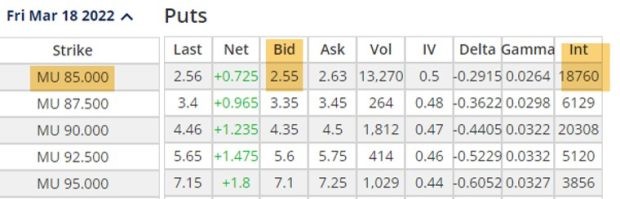

The option chain (MU trading at $90.15)

MU: Option-Chain Data

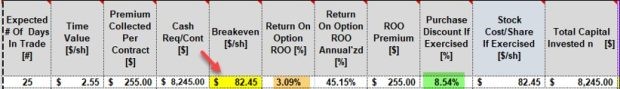

Initial put calculation results using the BCI Trade Management Calculator (TMC)

MU: Initial Trade Structuring Calculations

The two possible (non-adjusted) trade results are a 3.09%, 45.15% annualized 25-day return or the purchase of the shares at an 8.54% discount ($90.15 to $82.45)

Ultra-low-risk approaches

Delta

Using a deep OTM put strike with a low Delta (-0.10, as an example) will create an approximate probability of success. For example, using a Delta of -0.10 will create an approximate probability of 90% that the option will not explain the money or wi intrinsic value and therefore will not be subject to exercise.

Implied volatility

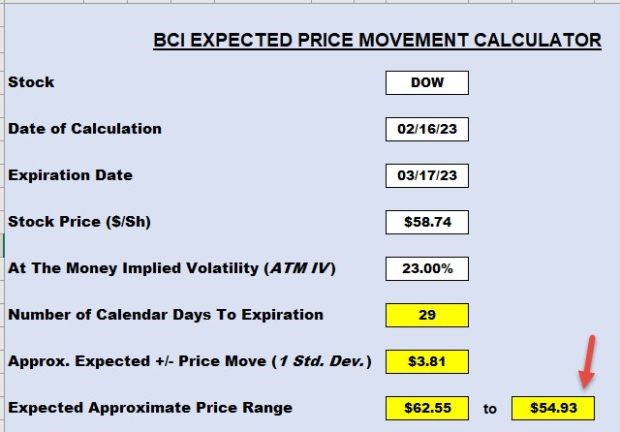

Using a mean or at-the-money implied volatility will allow us to create an approximate trading range for the stock or ETF during a specific contract cycle.

Using IV to Determine Expected Price Movement Over a Contract Cycle

Since IV stats are based on one standard deviation and a one-year timeframe, the BCI Expected Price Movement Calculator can determine an approximate trading range for a specific contract cycle. In this example with DOW, we would sell a put with a breakeven price point near $54.93 and have an 84% probability that the put will not be exercised.

Discussion

One of the outstanding benefits of selling cash-secured puts (and covered call writing, as well), is that the strategy can be crafted to meet several different strategy goals and appeal to investors of a wide range of personal risk-tolerances. The past two blog presentations highlight five such distinct pathways.

Learn more about Alan Ellman on the Blue Collar Investor Website.