We interrupt this raging bull market to update you on some historical positioning in the bond market that will impact your portfolio, whether you like it or not, asks JC Parets of AllStarCharts.com.

Even if you don't trade bonds, this is important. You see, I know it's easy to sit back and chill out with the S&P 500 making new 52-week highs, the Dow Jones Industrial Average and Dow Transportation Average making new 52-week highs, and, of course, the Nasdaq100 making new 52-week highs after posting its best first half to a year ever.

Market breadth continues to expand and sector rotation is frustrating the hell out of anyone trying to short this market. The thing is, what even changed? What happened that stocks have been ripping higher since last year? Positioning. It's not the economy that drives stocks. It certainly isn't fundamentals. It's positioning. Or mispositioning in the case of many hedge funds and other investors coming into the year. They were the shortest they were at any point during the last bear market.

Folks, 2023 is what a short squeeze looks like. And I don't feel bad for any of them. We all thank them. Short sellers are important. Remember, short sellers, are promising to be future buyers. Shareholders are only promising to be future sellers. Don't forget that.

And the fact that short sellers got their faces ripped off all year, was fuel to send stocks higher at a historically fast rate. So again, thank you angry permabears! Drinks on me! We have a similar setup now in bonds. Large Speculators have their most aggressive bet in the history of the bond market. They're shorter than ever.

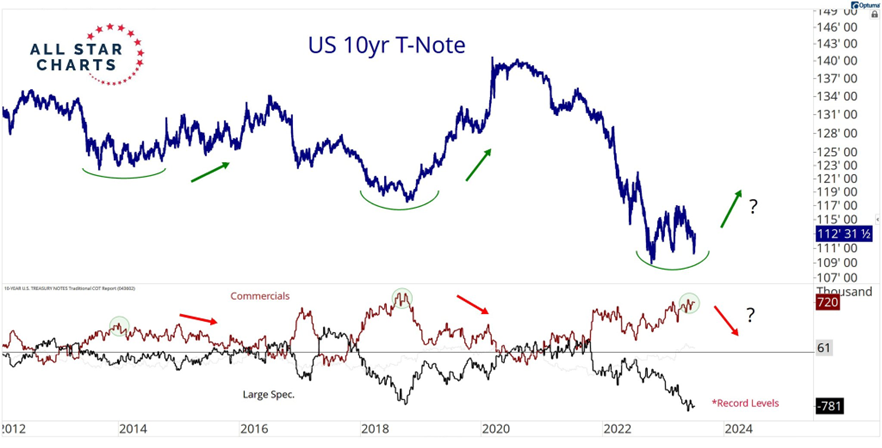

Here is a chart of the US ten-year Note showing Large Speculators, basically hedge funds and other large buy-side institutions, with their largest short positions ever.

When Large Speculators are at consensus, it consistently pays to take the other side of their bets. Take 2018 for example. At that time, the Large Specs had their largest short bets in the bond market ever. And bonds went on a historic run. I remember it well. Interest collapsed to new all-time lows. Now here we are. Large Spec is betting more aggressively than ever that the 40-year bull market in bonds is over, and a rising rate regime is here and here to stay.

Are you betting that bonds are about to collapse? Immediately after they just collapsed? We just saw the most significant rate of change in rising interest rates ever. And NOW they want to bet on rising rates? No thanks. We're taking the other side and looking to buy bonds and/or position ourselves in assets that benefit from lower rates.

One sector that is standing out as bonds are starting to get going is Bank stocks. I was promised a banking crisis, but all I got was one of the strongest bull markets in history. Here's what the S&P Bank Index looks like as it breaks out to new four-month highs:

How do you say, not a top? We started buying bank stocks last month and so far they're working. They seem to like these falling rates. Does this trend continue? Or are you betting along with the dumb money that bonds are about to fall apart, again, right after they already fell apart?

To learn more about JC Parets, please visit AllStarCharts.com.