The 11th hike in US interest rates since early 2022 is seen as a done deal today and we are now just waiting for the official announcement, states Ian Murphy of MurphyTrading.com.

With the base cost of borrowed dollars moving into the 5.25% to 5.5% band, we will also start transitioning to the most challenging part of the hiking cycle. This is the phase where the psychological impact of hiking has lost the power to influence behavior (because we have accepted rates are rising) and the real work of conquering inflation switches to the financial pain of servicing higher mortgage and credit card repayments.

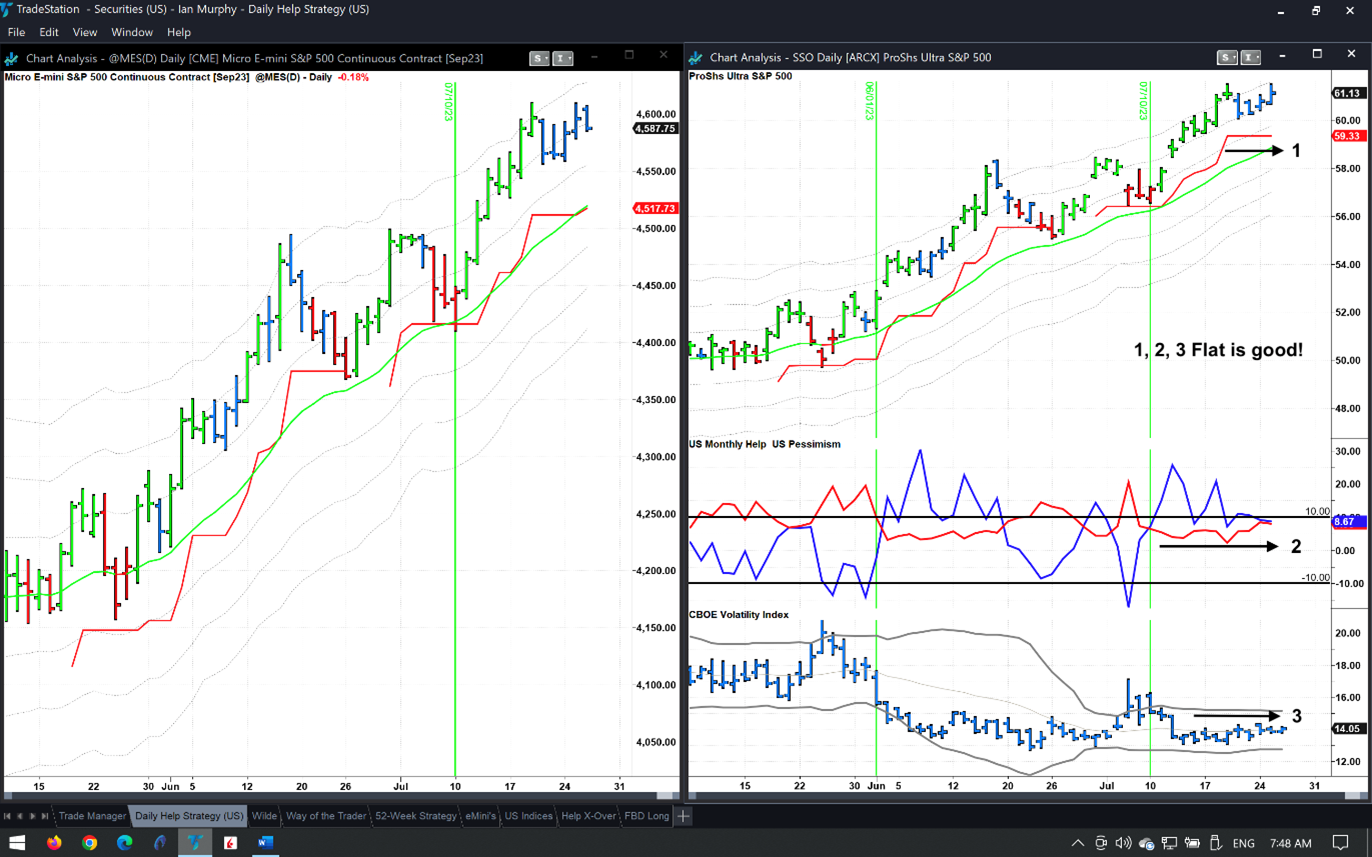

Meanwhile, the stock market keeps doing its thing and the Help Strategy trade from July tenth is up 7% on ProShares Ultra S&P500 2x Shares (SSO) based on yesterday’s close. The trailing stop flatlined last week, but pessimism remains suppressed thanks to strong tech earnings yesterday which boosted sentiment.

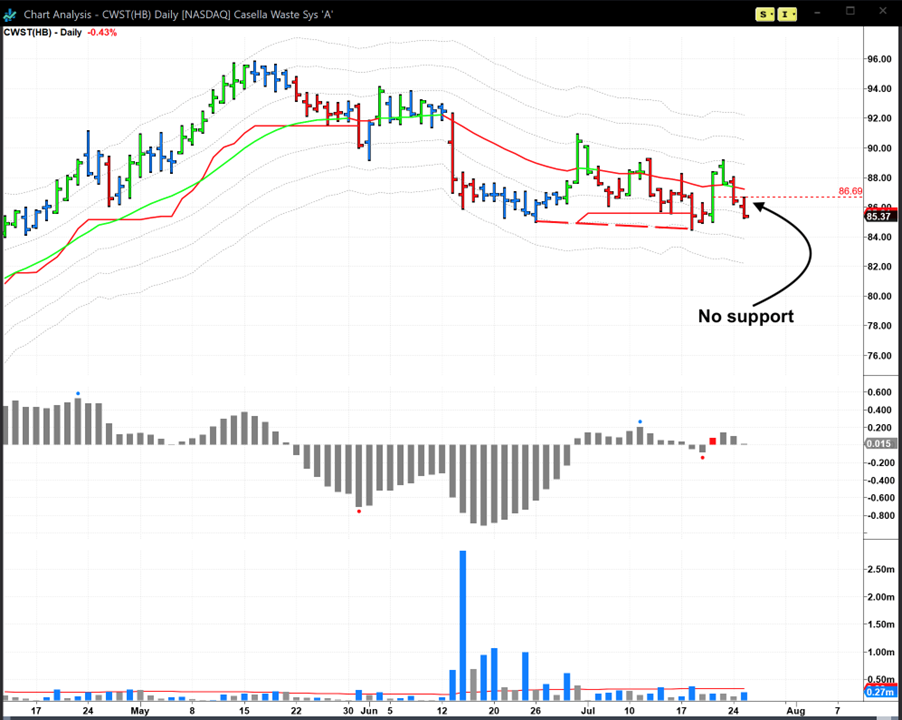

Monday’s trade idea for Casella Waste Systems Inc. (CWST) did not trigger an entry. I wrote, ‘If a 50% retrace of Thursday’s bar holds as support today ($86.69), it might be worth a punt'—it didn’t, so it wasn’t.

This is why it’s so important to wait for confirmed price action before entering a position. The price bars confirm the crucial difference between the possible beginning of a trend change with a swing to the upside, as opposed to the continuation of the established bearish trend.

Learn more about Ian Murphy at MurphyTrading.com.