This is one of the most frequently asked questions I receive from covered call writers all over the world. Should I use a 40-Delta? 35-Delta? Higher? Lower? The focus is on Delta when it shouldn’t be, states Alan Ellman of The Blue Collar Investor.

This article will use a real-life example with Etsy, Inc. (ETSY) to demonstrate why this is the wrong question to ask and how to target the best factors that will dictate our strike selections.

Factors that Should Determine Strike Selection (Not Delta)

- Initial time-value return goal range

- Moneyness of the option (ITM for defensive positions; OTM for more aggressive positions)

- Personal risk-tolerance

- Overall market assessment

Based on these factors, we can craft our portfolios to align with our trading style, strategy goal,s and the degree of risk we are willing to accept. These strikes will have a Delta stat but that is the endpoint, not the starting point.

Real-Life Example with ETSY

- 3/21/2023: ETSY trading at $108.11

- 3/21/2023: April 2023 monthly contracts expire on 4/21/2023

- Establish a projected price trading range for these 32 days based on implied volatility (IV) of the at-the-money (near-the-money) strike

Strike selection scenarios with appropriate strikes for each situation

- Traditional covered call writing- aggressive OTM ($115.00)

- Traditional covered call writing- defensive ITM ($100.00)

- Ultra-low-risk protection to the downside based on a projected trading range ($92.00)

- Ultra-low risk protection on the upside to avoid exercise scenarios (portfolio overwriting- $125.00)

- ATM strike to determine IV trading range calculations ($108.00 strike shows an IV of 53% as shown in the chart below)

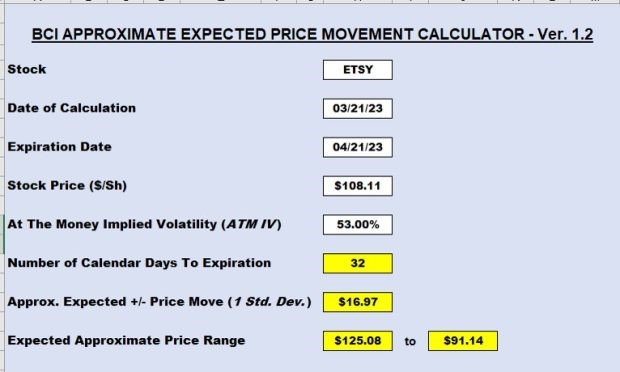

Implied Volatility Projected Trading Range Using the BCI Expected Price Movement Calculator

ETSY: Expected 32-Day Price Movement Based on an IV of 53%

There is an 84% probability that ETSY will not supersede the upper end of the range ($125.08) or fall below the lower end ($91.14).

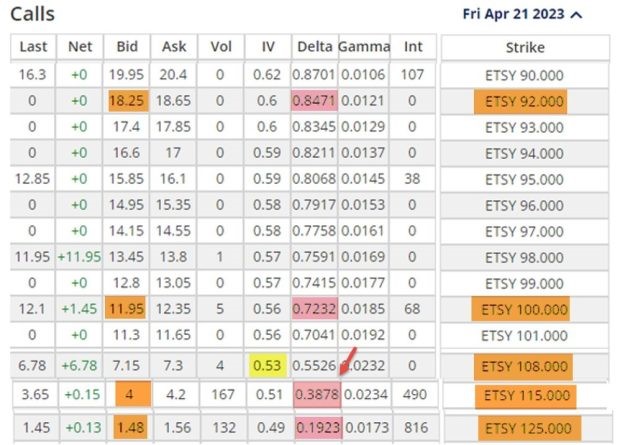

ETSYoption Chain on 3/21/2023

ETSY Option-Chain Showing IV, Delta, Strikes, and Bid Prices

Note the following:

- The ATM $108.00 strike shows an IV of 53% (yellow cell)

- The only strike with a Delta between 35 and 40 is the $115.00 strike which would eliminate the other three scenarios if restricted to one delta

- The bid prices (brown cells) will be used for initial calculations (time-value, breakeven price points, upside potential, and downside protection)

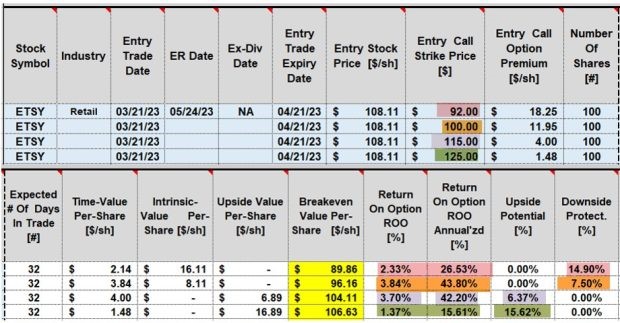

Calculations Using the BCI Trade Management Calculator (TMC)

ETSY Calculations for Four Proposed Scenarios

Pink cells: The $92.00 strike generates an initial 32-day time-value return of 2.33%, 26.53% annualized, with 14.90% downside protection of that time-value profit. The breakeven price point is $89.86.

Brown cells: The $100.00 strike generates an initial 32-day time-value return of 3.84%, 43.80% annualized, with a 6.37% upside potential if the share price appreciates up to the OTM call strike. The breakeven price point is $96.16.

Purple cells: The $115.00 strike generates an initial 32-day time-value return of 3.70%, 42.20% annualized, with 6.37% upside potential if share value appreciates up to or beyond the OTM call strike. The breakeven price point is $104.11.

Green cells: The $125.00 strike generates an initial 32-day time-value return of 1.37%, 15.61% annualized, with a 15.62% upside potential if share value appreciates up to or beyond the OTM call strike. The breakeven price point is $106.63.

Discussion

The factors to choose from when selecting strikes for our covered call writing positions include initial time-value return goal range, overall market assessment (aggressive or defensive,) and personal risk tolerance. Using Delta as the sole determining factor will restrict our choices and not allow us to craft our portfolios to the key components of our trading system.

***One partial exception to this “assault” on the Delta edict is that we can focus on Delta when using ultra-low risk strategies but then the strike must also align with our pre-stated initial time-value return goal range.

Learn more about Alan Ellman on the Blue Collar Investor Website.