The GBP/USD is among the key currency pairs to watch this week, owing to the release of some important macro data from both sides of the pond, states Fawad Razaqzada of Trading Candles.

The Bank of England remains firmly focused on services inflation and wage growth. We will have data on both fronts in the week ahead, which should impact the GBP/USD outlook in the direction of the surprise.

Key Data Releases to Watch for the Cable This Week

The following the data releases have the potential to move the GBP/USD this week:

From the UK, we will have wages data on Tuesday, ahead of the more-important consumer inflation data a day later on Wednesday and the not-so-important retail sales figures on Friday.

From the US, we will also retail sales on Tuesday, as well as the FOMC meeting minutes on Wednesday among several other second-tier data releases throughout the week.

The UK inflation numbers in mid-week could determine how many further interest rate hikes the Bank of England has left in the tank, something which will in turn impact the GBP/USD outlook in the direction of the surprise.

How Will This Week’s Inflation and Wage Data Impact BoE Thinking?

The pound has been primarily driven this year by inflation overshooting to the upside, boosting expectations that the BoE could—as it has—tighten its policy further into the contractionary territory.

However, the market’s odds of a future BoE hikes weakened somewhat from its lofty levels, following the last inflation report which came in somewhat sharply below expectations, albeit at a still very high 7.9%, from 8.7% in the previous month.

While there’s now hope that inflation has peaked, the market will want to see further evidence of a disinflationary trend before it is convinced that the BoE is done with tightening.

Wednesday’s inflation report is again expected to show further evidence of cooling prices, with a headline of 6.7% year-on-year expected compared to 7.9% in the month prior. The drop is likely to be driven by energy and food.

One big issue for the BoE is inflation in the services sector, and strong wage growth. On the latter front, we will get to see exactly how strongly wages grew in the three months to June, on Tuesday. Economists expect the average earnings index to have climbed to +7.2%, accelerating from the previous month's stronger-than-expected +6.9% print.

A25 basis point rate hike on September 21 is expected by markets, although not 100 percent. So, if this week’s wages and inflation data come in surprisingly strong, then this will cement expectations of a hike while also boosting speculation that the BoE could tighten its policy again in November.

Conversely, a weaker-than-expected set to of data could mean September could be a coin flip or at best the last rate hike in the cycle. This should weigh on the pound.

UK Economy Defying Expectations

Heading into this week’s key data releases, we had some positive data surprises from the UK on Friday of last week, which prevented the GBP/USD to fall deeper in the 1.26 range, while other currencies struggled against the dollar.

Investors were relieved to find out that the UK economy unexpectedly rebounded by 0.5% in June, helping to fuel a 0.2% growth on the quarter-over-quarter basis, and defying expectations for no growth. Growth was boosted by manufacturing while business investment and construction were also stronger, despite the BoE’s aggressive rate increases.

Still, one key risk facing GBP investors is the UK housing market, which has been slowing more rapidly than expected of late thanks to high mortgage rates. This is something that could weigh on the pound in the future.

Why Hasn’t the Dollar Sold off Yet?

The US Dollar Index has started the new week on the front-foot, having momentum behind it with four consecutive weeks of gains.

We have had pockets of weakness in US data, which should have undermined the dollar. But the fact it hasn’t means it is probably boosted by the risk-off tone in the markets, most notably in China. Here, equities and renminbi both continue to struggle, putting pressure on the positively correlating markets such as the Aussie and kiwi, and thus indirectly boosting the US dollar. Concerns surrounding the perilous financial state of some of China’s largest property developers and the nation’s post pandemic economic struggles have dented investor sentiment.

Also keeping the dollar supported is the economic struggles elsewhere around the world, discouraging investors from building long positions in foreign currencies—although we are starting to see signs of resilience in some economies, for example the UK. Perhaps investors are waiting to see more evidence that the US economy is on a clear downward trajectory, before shunning the dollar again. So, it is important to look for signs of a slowing economy, and not just inflation figures, if you are a dollar bear.

So, watch this week’s data releases closely from China and the US as they have the potential to move the markets, including the GBP/USD.

The Fed itself needs more conviction that it is winning the fight against inflation, as some members continue to warn that the central bank still has “more work to do” on prices. Last week saw core inflation ease a tad further to 4.7% while the headline rate edged higher because of base effects to 3.2%, albeit this was better than expected. Price pressures abated nearly across all components, expect the housing market. With interest rates being high, this isn’t going to last very long – we think. And the market agrees, as the probability of another rate hike fell even further.

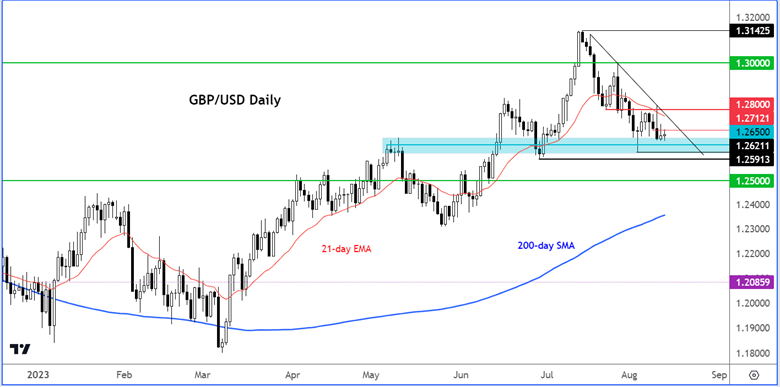

GBP/USD Technical Analysis

The GBP/USD’s short-term trend remains bearish given that it has created some lower highs of late. Yet, the downtrend is not very strong, yet. Indeed, the big, inverted hammer candle from Thursday has so far failed to bring out fresh sellers in the cable. Instead, the bulls have managed to defend support in the 1.2650-1.2700 range for now.

The bulls will want to see a daily close north of 1.28 handle to provide the signal that the GBP/USD is going higher again.

The bears are happy for now but will be more so if we get a break below 1.3591 – the last swing low—for then we will have a lower low in place.

Source: TradingView.com

To learn more about Fawad Razaqzada visit TradingCandles.com.