The media has been love-stricken with mega-cap technology stocks this year. After a mammoth runup, it’s not surprising, states Alec Young of MAPSignals.

It’s now become the mainstream view, making it less appealing. There’s a bigger opportunity in smaller unloved equities. If you’re curious on when to bet big on small caps, history points to NOW. Look, fans of MAPsignals know we’ve been bullish all year. It’s been an amazing run. But the market’s gotten overbought. The Big Money Index (BMI) peaked at a red hot 83.9 on August 1. It’s no surprise stocks are taking a well-deserved breather. The good news is this bull market’s not over. Today I’ll show you what to buy as stocks pull back.

When to Bet Big on Small Caps

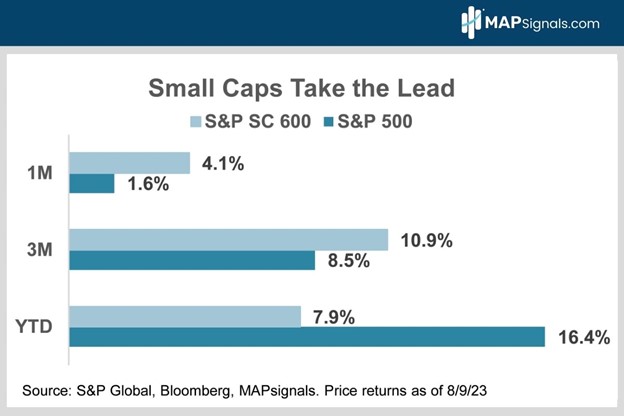

On July 10, we predicted the market would broaden out. That’s exactly what’s happening. After trailing big in the first half, cyclical sectors like energy, materials, industrials, and financials are playing catchup as the economy continues to defy the skeptics. Meanwhile, the tech-heavy S&P 500 (SPX) has stalled out as the mega caps consolidate their monster run. Small cap indices like the Russell 2000 and the S&P Small Cap 600 are recently outperforming as they’re loaded with cyclical stocks. On a one-month basis the S&P SC has gained 4.1% vs only 1.6% for the S&P 500. Out to three months we see the same with small caps up 10.9% vs. 8.5% gains in large caps:

If you’re considering fading this recent outperformance, think again. Here are the top four reasons now’s the time to buy small caps.

#1. More Cyclical: Small caps’ more cyclical sector mix means they do best when the economy is improving. Recession fears are fading. Small caps are finally leading as MAPsignals’ long-held, soft-landing call is now the consensus view.

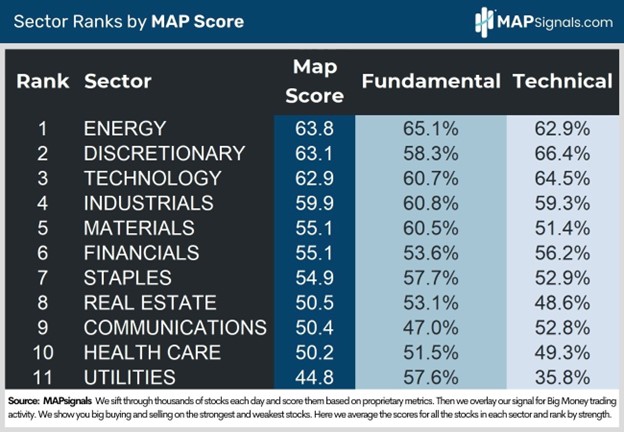

#2. Less Interest Rate Sensitive: As the economic outlook has improved, 10-year Treasury yields are back up to 4%. That’s fueling healthy profit taking in the pricier, longer duration tech stocks that dominate the S&P 500. After being #1 all year, tech has dropped to our 3rd highest ranked sector. The S&P SC 600 only has 16% in tech and communications vs. 37% for large caps.

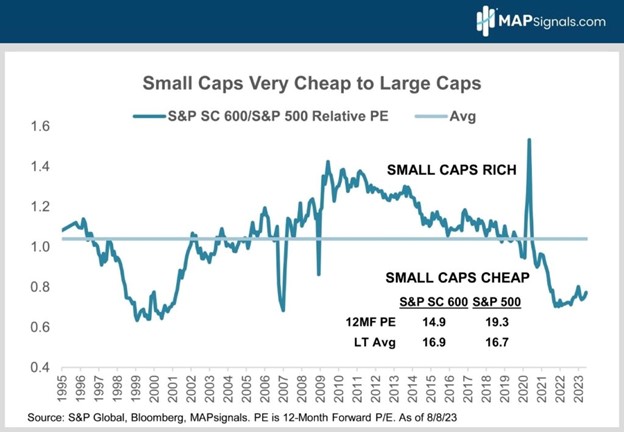

#3. Rock-Bottom Relative Valuation: Small caps are very cheap compared to the S&P 500. Since 1995, small caps have averaged a 4% valuation premium to large caps because they’ve delivered slightly higher long-term returns.

Right now, they’re trading at a 23% discount to the S&P 500’s forward PE of 19.3X:

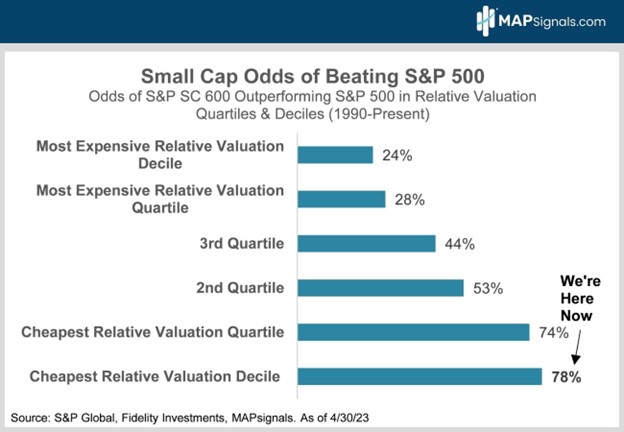

If you’re looking for value, small caps are the answer. But it gets better. When small caps have been this cheap to large caps, they’ve historically outperformed 78% of the time over the next 12 months. If you’re still wondering when to bet big on small caps, it’s now. Odds don’t get much better than that on Wall Street!

Beating the S&P 500 is great, but what kind of small cap returns should you expect?

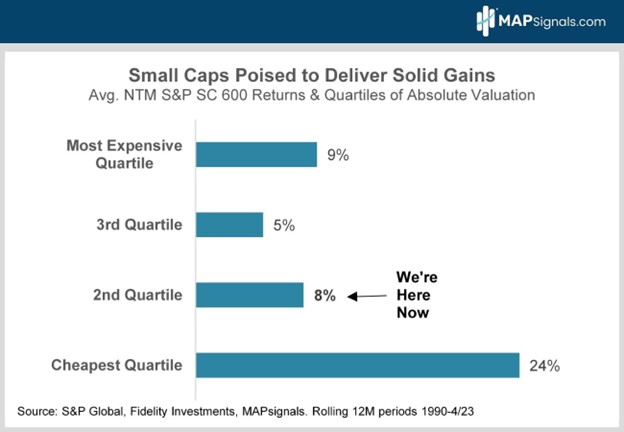

#4. Attractive Absolute Valuation: The S&P Small Cap 600 Index trades at just 14.9X 12MF earnings, vs. a long-term average of 16.9X. That puts small caps in their 2nd cheapest valuation quartile since 1990.

The index has historically posted an 8% average 12-month forward gain when starting from the 2nd cheapest valuation quartile. Remember that small caps are already up 20% from their October 2022 lows. 8% may not be smoking hot but it’s not bad on top of a 20% rally. And the S&P SC 600’s 1.5% dividend yield takes the total return up to 9.5%.

If you want to make money with stocks, you’ve got to focus on areas not in the spotlight. Here’s how to bet on a cyclical rebound.

How to Play it

The S&P Small Cap 600 Index is my go-to small cap index. Why? The S&P 600 index is a higher quality benchmark than the Russell 2000 because it requires its constituents to be profitable. According to the latest data from JP Morgan, 45% of Russell 2000 constituents lose money. Money losers rely heavily on debt to stay afloat, leaving them much more vulnerable to higher rates. No thanks. Plus, the $72B iShares Core S&P Small-Cap ETF (IJR) has a rock bottom expense ratio of just 0.06%, vs. a relatively hefty 0.19% for the $55B iShares Russell 2000 ETF (IWM). IJR also has a higher MAPsignals map score of 59 vs. 56 for IWM. Money is flowing to IJR. IWM used to own the category, now, not so much. The choice is clear.

Let’s take a quick look at IJR’s sector mix.

IJR gives you 45% combined exposure to newly outperforming cyclical sectors like energy, industrials, financials, and materials. Energy is now our top ranked sector map score of 63.8. Industrials rank fourth at 59.9, materials 5th at 55.1 and financials 6th at 55.1 also. All of them have been rising lately. In short, small caps’ sector mix is increasingly well suited for this market environment. Here’s a snapshot from our portal of the latest MAPsignals’ sector ranks:

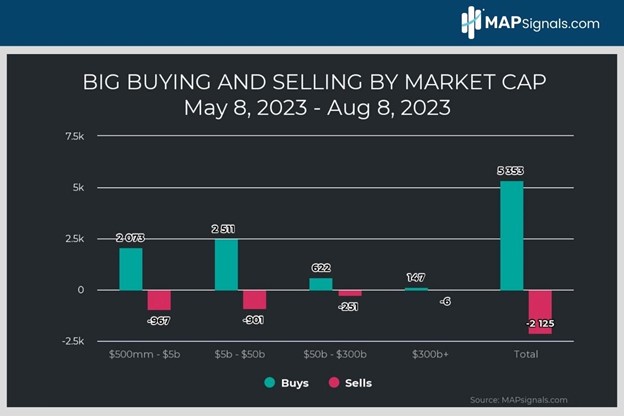

And finally, our data has been tracking lots of money rushing into small caps the last three months. You can see that below in our Buys and Sells chart by market cap. The macro backdrop favors small caps right now. And the Big Money confirms that message. That’s a strong 1-2 punch!

Bringing It All Together

Many are still worried that the economy is on the verge of a big slowdown. If that happens depressed small cap valuations already discount sluggish earnings. And if the economy remains resilient, all that skeptical money will be forced to chase small caps at higher and higher prices! It’s really a win-win set up when you think about it. And don’t forget small caps have a great track record of beating the S&P 500 and posting solid gains when they’re this cheap. Plus, they’re less sensitive to looming macro risks like rising long-term interest rates. Throw in less exposure to overbought tech stocks and a bigger allocation to the newly resurgent energy, materials, and industrials sectors, and you’ve got a recipe for success. Add it all up and small caps just offer a better risk reward trade-off than large caps right now. That’s why they’re starting to outperform.

Now’s the time to bet big on small caps.

To learn more about Alec Young, visit Mapsignals.com.