Is now the time to get long equities? If you kept up with the headlines and what the sell side analysts have to say, you'd think it would be, states JC Parets of AllStarCharts.com.

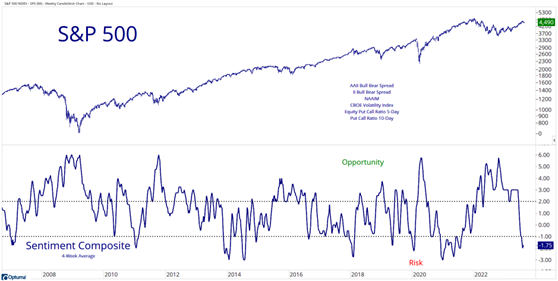

Fortunately, we try to stay ahead of the curve around here. Yesterday, we discussed the recent sentiment shift among permabears, Wall Street analysts, hedge funds, and financial media. To add to that sentiment shift, here is our internal sentiment composite, which includes data from individual investors, advisories, active investment managers, volatility and the options market. As you can see last year saw some of the most pessimistic levels in history, giving us one of the greatest buying opportunities we've ever seen. Today, sentiment is at the opposite extreme:

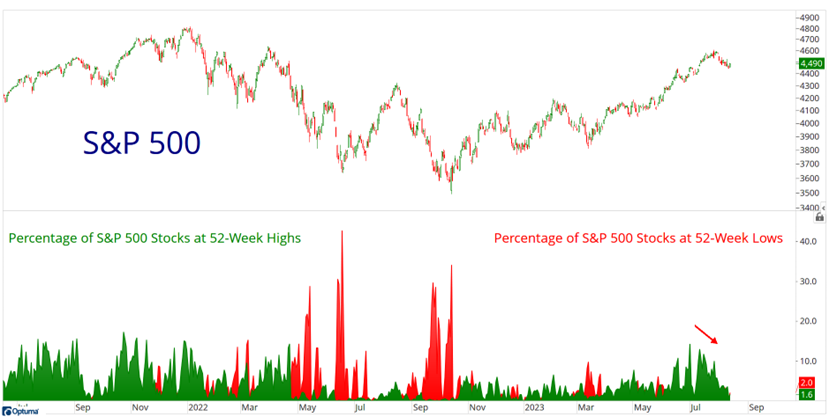

Where sentiment brought opportunity last year, today it adds a high level of risk for investors. You can see the recent breadth deterioration as well

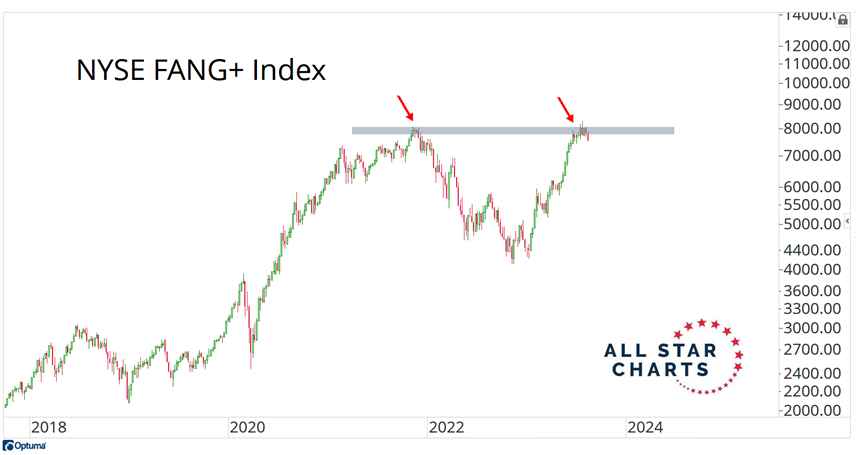

This last high in S&Ps came with very little participation. In fact, the new 52-week highs list peaked a month ago. Meanwhile, the largest components of the S&P 500 (SPX) are running into former resistance from the top of the prior cycle. Last time the NYSE FANG+ Index was up here, prices got cut in half within a very short period of time. Can we see that again?

As investors, I don't think aggressively betting on a repeat of 2022 makes the most sense. For me, I'd rather just sit back and wait to see what happens. And I'm going to be VERY patient. I'm not in any rush to pile into these things any time soon. I'll let the market prove that it's time once again.

This could take weeks, maybe even months. Potentially it could take quarters. And just maybe, it never breaks out at all. Realistically, I don't believe this last scenario is the high probability outcome. I do think it breaks out and it could even happen before the end of the year, or early 2024. But I'm willing to wait a lot longer. And from the looks of sentiment right now, it seems most investors are not willing to wait. They're already piling in.

A good rug pull for these late arrivals is the perfect way for the market to wipe them all out. That's what we're currently seeing, and I think it's great, as long as we're not one of the bag holders.

Getting left behind holding other people's bags is no way to go through life. That's why we analyze so much sentiment and price trend data around here. Our goal is to continue to stay ahead of these turns. How about you? What are you doing in this environment?

To learn more about JC Parets, please visit AllStarCharts.com.