Recent rate hikes in the US and Europe are causing ripples around the globe, states Ian Murphy of MurphyTrading.com.

Argentina abruptly devalued its currency by 18% and hiked the key interest rate to 69.5% on Monday as the South American country finally admitted defeat in a prolonged and vain attempt to defy market forces. The unexpected success of a far-right anti-bank populist in a runoff election may also have forced the bank’s hand.

On Tuesday, Russia called an emergency meeting of its central bank and announced a sudden rate hike to 12% in an attempt to support the battered rouble, which has fallen below 100 to the USD. Elvira Nabiullina, the central bank Governor in Moscow is well respected by her peers, but time will tell if she retains her independence (or job) when the pain of higher rates starts to bite.

These sudden rate hikes catch the headlines, but it’s debatable how much real impact they will have on US stock prices. Likewise, the decision of Country Garden, China’s largest property developer to pause bond payments over the weekend shouldn’t impact US stocks but the events are increasing nervousness among traders now that earnings for Q2 are out of the way.

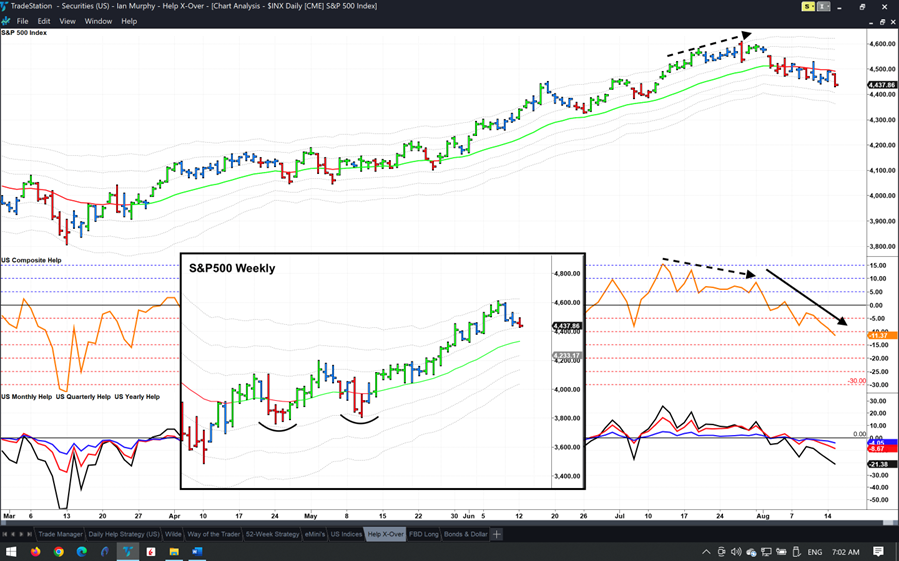

On a daily chart the S&P 500 (SPX) has been flirting with the -1ATR line for the past seven sessions without making a commitment but finally took the technical plunge into bearish territory in Tuesday’s session. I would not hit the panic button just yet as the index is still bullish (just about) on a weekly chart (insert) and could pullback another 4.6% to the -1ATR line (currently at 4233) and find support as in the past (curves) before recovering and going higher. If this was to occur, the bullish trend would remain intact.

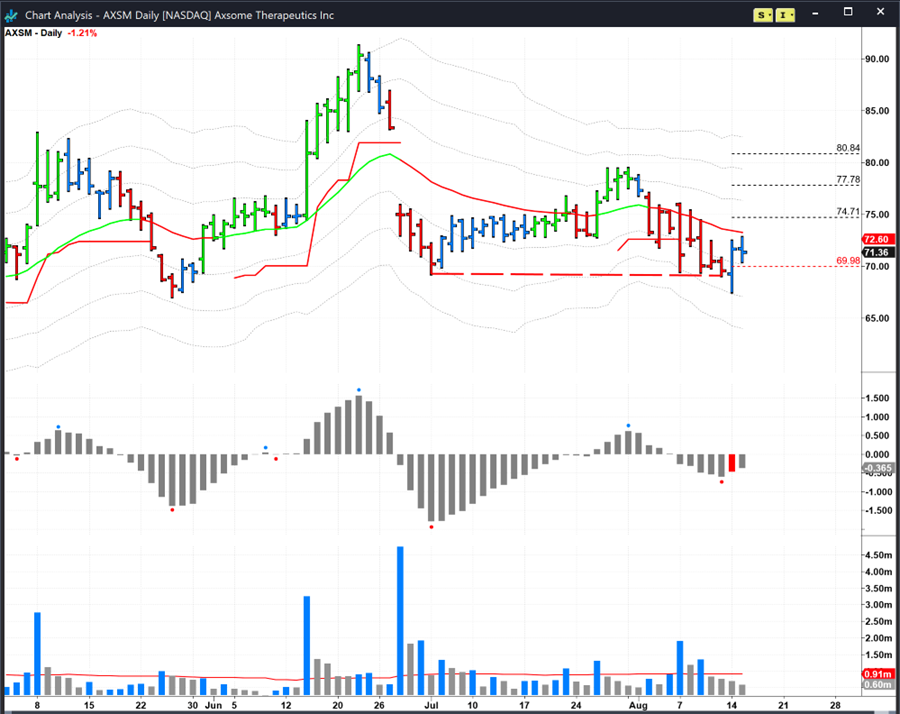

Meanwhile Monday’s trade idea for biotech firm Axsome Therapeutics, Inc. (ASXM) triggered an entry with the targets shown above. Considering the height of the price bar which triggered this one, I would place a soft stop at a 50% retrace ($69.98) rather than a hard stop 0.5ATR under the bar—the risk/reward ratio is too high down there.

Considering the nature of this firm, the high short float and the current market mood, we should grab profits quickly if it pops to the upside by taking at least ⅔ off the table. If nothing happens by Friday, I would close out the trade totally.

Learn more about Ian Murphy at MurphyTrading.com.