The regime change in the market is real. It's much different today than it was in the first half of the year, states JC Parets of AllStarCharts.com.

And that's perfectly normal. Anything else would actually be very unusual. The strategies that worked in the first six months are not working well in this environment. But the strategies that did NOT work in the first half of the year are much better in the current market. For example, high volatility strategies were mostly terrible in the first half of the year. That's because we were in a low volatility environment. It was our low vol strategies that worked great for us.

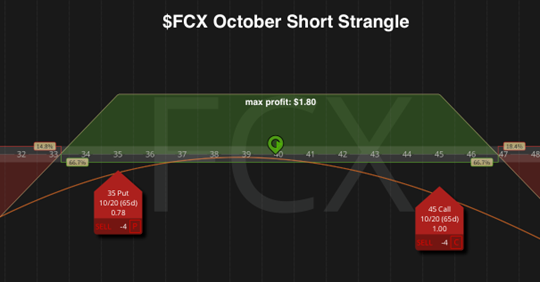

So, since the market is behaving differently now, then so are we. Volatility is a little more elevated, so that means we're getting paid to play. That wasn't the case earlier this year. Freeport McMoRan (FCX) for example, has some juicy premiums and is trading in a massive range.

Perfect:

So, what does that mean exactly? For me, it means we can collect income while the market penalizes investors who are still incorporating the strategies that were working earlier in the year. Those betting on a direction are likely to lose money in a directionless market. Those betting on a lack of direction (like us) are much more likely to profit from this stock in the coming months. So that's exactly what we did. We sold the October 35/45 short strangle. And while that might sound a little scary or complicated, if you're newer to options, it's really not. All we did was sell the October 45 calls and sold an equal amount of the October 35 puts.

That's it:

The goal here is simple: If we/when we can buy back those options we sold for approximately half of what we sold them for, then we go ahead and do that and close out the trade for a profit. In other words, if we sell, let's say, $100,000 worth of options here, between the Oct 45 calls and the Oct 35 puts, then when we can buy them back for $50,000, we'll go ahead and do that. In this scenario, we make $50,000 in profits, or whatever half of what you sold ends up adding up to.

But the bottom line is whether you enter this trade yourself, or you're selling premium in other stocks, or you're in much more cash these days, the market is different now. Have you adapted with the changing environment? What are you doing about it?

To learn more about JC Parets, please visit AllStarCharts.com.