The chart of the day belongs to the under-followed insurance company SiriusPoint (SPNT), states Jim Van Meerten of BarChart.com.

I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and a Trend Seeker buy signal. I then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 7/21 the stock gained 19.62%.

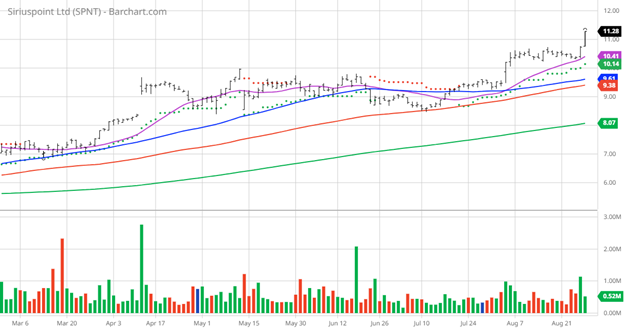

SPNT Price vs. Daily Moving Averages

SiriusPoint Ltd. provides multi-line insurance and reinsurance products and services worldwide. The company operates through two segments, Reinsurance, and Insurance & Services. The Reinsurance segment provides coverage to various product lines, which includes aviation and space, casualty, contingency, credit and bond, marine and energy, mortgage, and property to insurance and reinsurance companies, government entities, and other risk-bearing vehicles. The Insurance & Services segment offers coverage to various product lines comprising accident and health, environmental, workers' compensation, and other lines of business, including a cross-section of property and casualty lines. The company was formerly known as Third Point Reinsurance Ltd. and changed its name to SiriusPoint Ltd. in February 2021. SiriusPoint Ltd. was incorporated in 2011 and is headquartered in Pembroke, Bermuda.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 142.80+ Weighted Alpha

- 154.63% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 10 new highs and up 18.86% in the last month

- Relative Strength Index 79.17%

- Technical support level at $10.47

- Recently traded at $11.28 with a 50-day moving average of $9.61

Fundamental Factors:

- Market Cap 1.77 billion

- P/E 28.03

- Revenue guidance not given

- Earnings are estimated to increase 165.10% this year and continue to compound at an annual rate of 15.00% for the next five years

Analysts and Investor Sentiment: I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide.

- Wall Street analysts gave one hold opinion on the stock

- The individual investors are not following the stock on Motley Fool

- Value Line gives the stock its highest rating of one with a price target between $7 and $20 with a consensus of $14 for a 25% gain

- CFRA's MarketScope rates it a buy

- 2,390 investors monitor the stock on Seeking Alpha

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in the next 72 hours.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least every week.

Learn more about Jim Van Meerten at BarChart.com.