We've already had success with Google (GOOG) trades this year. But since the strength there continues, despite a seasonally weak cycle time, we're going back to the well, states JC Parets of AllStarCharts.com.

We put on another bullish bet on Google yesterday. Here's what that chart looks like with important support near 125 and the former all-time highs up near 150:

Here's the Thought Process

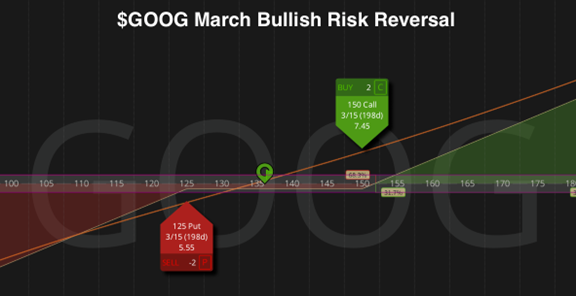

Google continues to show relative strength and we'd like to take advantage of a move higher from here towards those former all-time highs near 150. The March 150 Call options were about $7.50 which feels expensive. So if we also sell the March 125 Put Options for $5.50, that helps pay for most of our Calls. This makes it a $2.00 net debit to initiate the long position in Google. Our strategy here is called a "Bullish Risk Reversal":

Just because the trade is in doesn't mean we just set it and forget it. We have a plan. Also, remember that over the past few weeks, we already took advantage of the slightly elevated implied volatility by collecting some cash in shares of Microsoft last week and in Freeport McMoRan the week before.

To learn more about JC Parets, please visit AllStarCharts.com.