Stocks are messy these days. The major indexes peaked in July and the new 52-week highs list topped out almost two months ago, states JC Parets of AllStarCharts.com.

This is all perfectly normal market behavior for this time of the year if markets were behaving any differently, then THAT would be unusual. Just like over the past three quarters. If stocks didn’t do as well as they did, again, that would have been weird. The market continues to behave according to historical trends, obnoxiously so. And to be clear, it’s when the market ignores seasonal tendencies that we want to pay more attention because THAT is the signal.

In the meantime, we’re just chugging along in one of the more normal years for the market that we’ve ever seen. So during this messy Q3 period of the pre-election year, with the indexes stuck below overhead supply, volatility is higher than it’s been in a while, especially among Consumer Staples stocks. So what should we do in a directionless market, with higher-than-average age volatility?

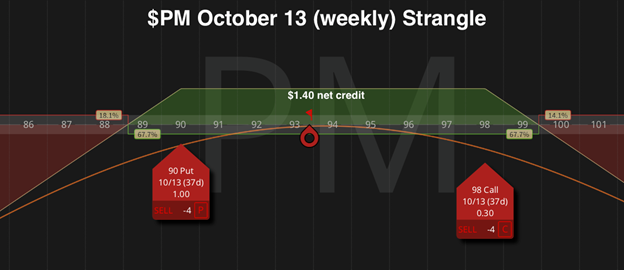

Give the people what they want! Sell them the Calls, AND sell them the puts too! Collect that cash baby! So that’s exactly what we did. We sold a strangle in Philip Morris (PM) betting that this messy market remains messy over the next month or so:

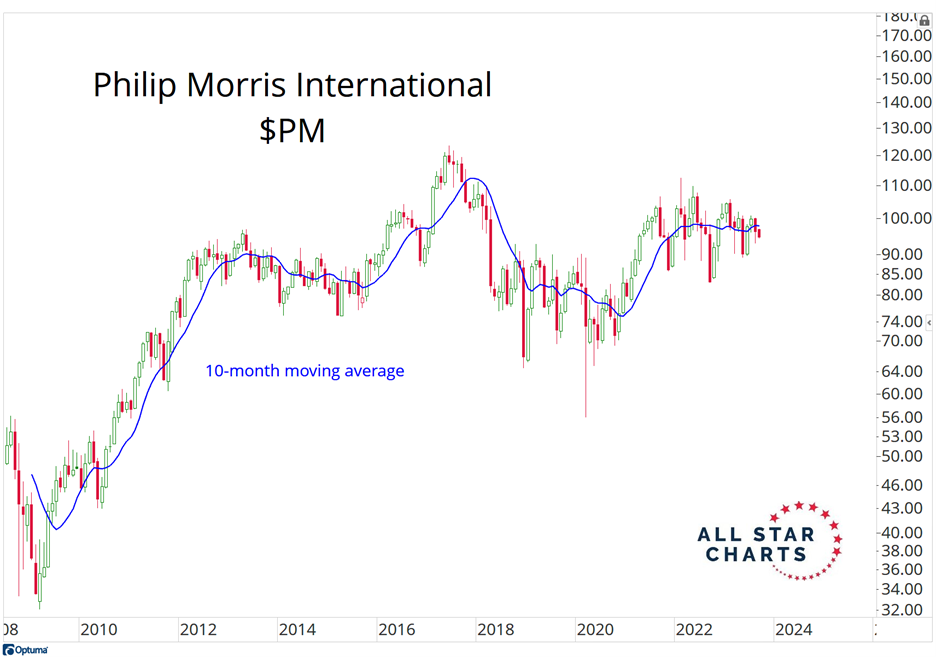

Notice that the flat ten-month moving averages get right in the middle of its range. This is equivalent to roughly a 200-day moving average. I wanted to zoom out to give you some perspective. This stock is messy in the short term within the context of a longer-term mess. Mess on mess on mess. The lack of direction here very much plays in our favor.

So that’s the bet we’re making. We sold the $PM October 98 Calls and an equivalent amount of the 90 puts. *Notice how we’re selling the October 13 (Weekly) option to avoid any added earnings volatility.

Make sure to read all the risk management details a profit-taking strategy here. There’s a time and a place for everything. Earlier this year we were not putting on trades like this. Volatility was low, and the market was trending higher. Buying stocks and possibly some cheap call options made a lot more sense. A trade like this one likely wouldn’t work very well in that prior environment. But this isn’t April.

It’s a new regime. Remember we talked about this? And so we’ve been acting accordingly. What are you doing in this environment? Are you forcing a strategy that is not a conduit for this type of market behavior? Or are you adapting your strategies for the market we’re in? Know which game you’re playing.

To learn more about JC Parets, please visit AllStarCharts.com.