A busy week in the money markets lies ahead as the Fed, the Bank of England, and the Bank of Japan are due to announce their latest interest rate decisions, states Ian Murphy of MurphyTrading.com.

Meanwhile there are growing signs of major labor unrest in the US with the walkout of United Auto Workers from car plants.

Something else which caught my eye over the weekend was the announcement of a prisoner swap between the US and Iran. When viewed alongside the recent rapprochement with Venezuela, it looks as if the Biden administration might be keen to bring more oil supply to the market to compensate for production caps announced by Saudia Arabia and Russia.

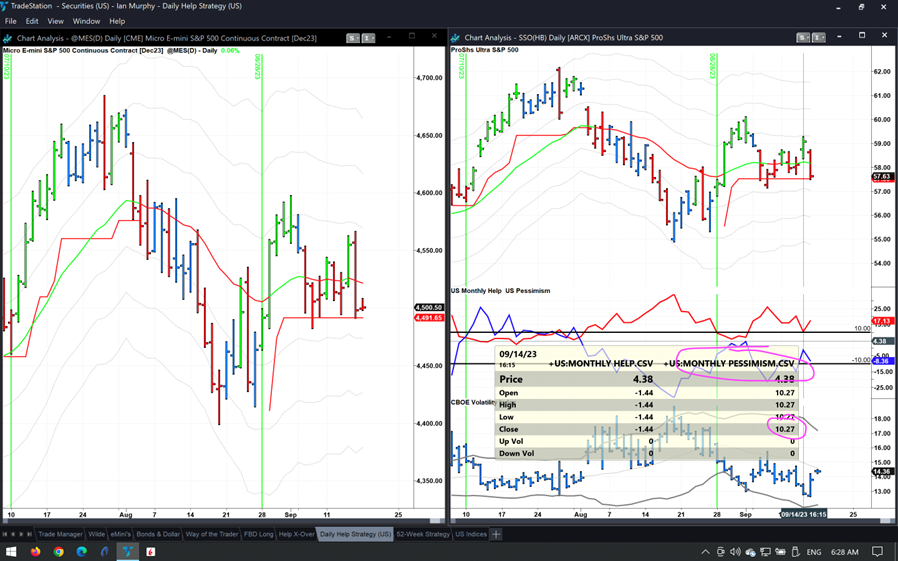

Our old friend the Help Strategy came within a whisper’s breath of triggering on Thursday, but Pessimism stepped over the 10% threshold during the session to close at 10.27% (highlighted in pink). Everything else was fine (price, VIX and Help Indicator) but new 20-day lows failed to decrease enough. It’s probably just as well because the selloff continued on Friday and the level where the initial stop would have been was taken out.

Learn more about Ian Murphy at MurphyTrading.com.