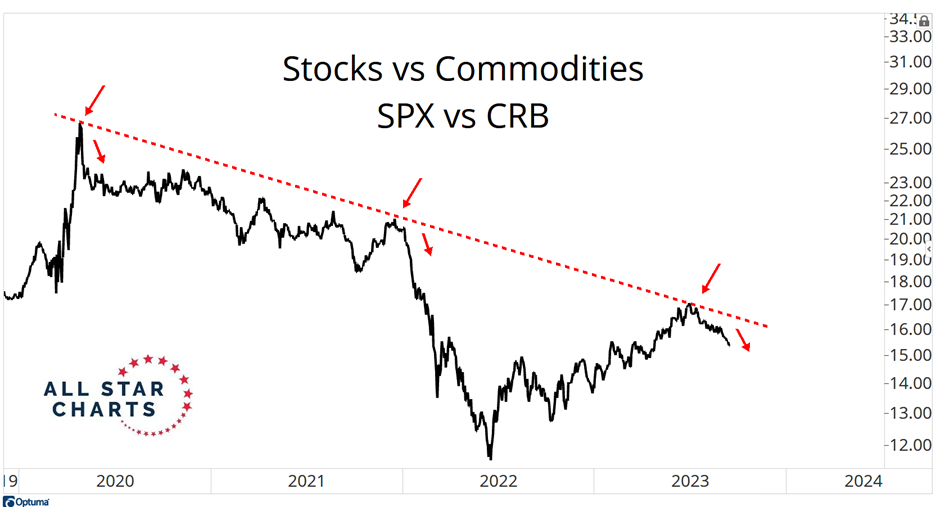

Is this the world’s most important trend that no one is talking about, asks JC Parets of AllStarCharts.com.

How many people do you know would tell you that stocks are already in their fourth year of a downtrend relative to commodities? In other words, how many people do you know that would argue we are now in year four of a Commodities Supercycle? Here’s what this looks like:

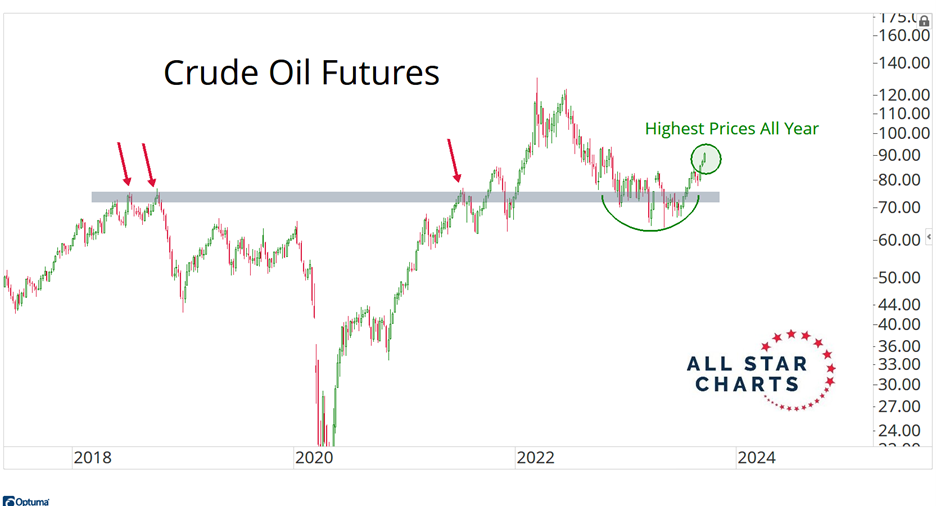

Meanwhile, take a look at Crude Oil Futures hitting the highest prices all year:

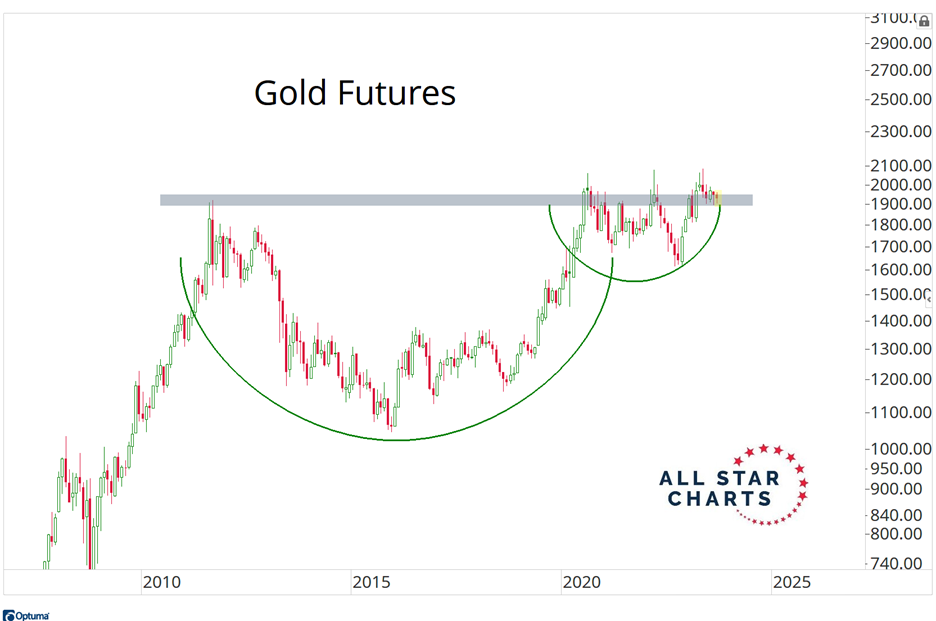

Based on the weight of the evidence, this Commodities Supercycle is well on its way. To be sure, there’s little evidence that would suggest otherwise. And while we can argue that Gold acts more like a currency than a commodity, we don’t see Commodities Supercycles without Gold prices participating. So a breakout here looks inevitable:

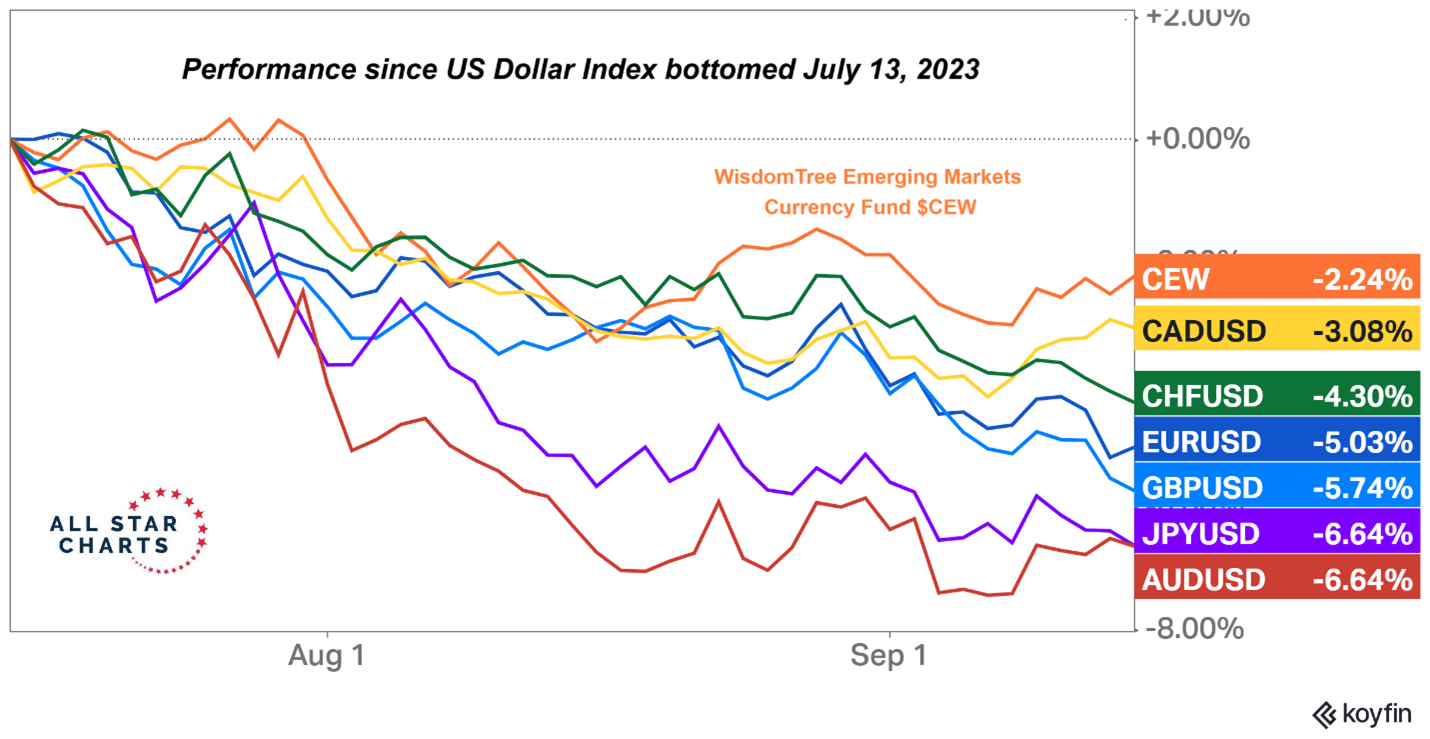

Another major theme on last night’s call was the fact that the new 52-week highs list peaked on the NYSE and Nasdaq at the same time that the US Dollar bottomed. That is NOT a coincidence. But what stands out here is how well Emerging Market Currencies have held up relative to Developed Market Currencies:

There are opportunities in stocks right now, but very different ones than we saw during the first half of the year.

To learn more about JC Parets, please visit AllStarCharts.com.