The US Stock Market is mostly one big fat mess, it is perfectly normal for this time of the year, so no surprise there, states JC Parets of AllStarCharts.com.

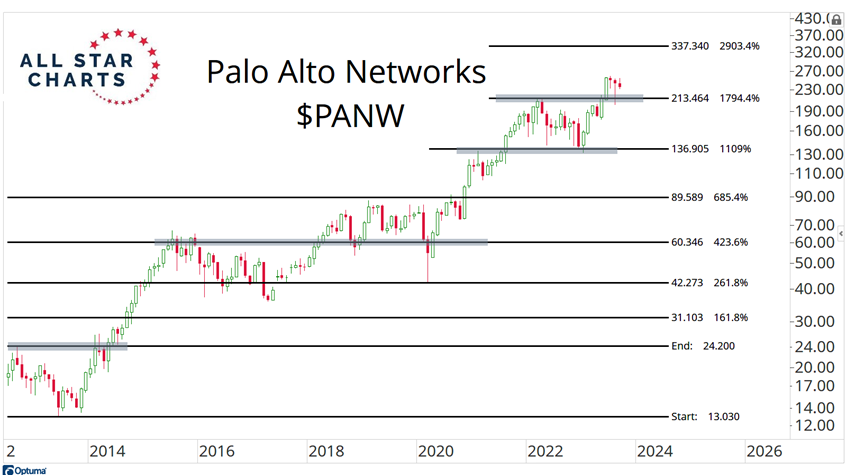

But the bottom line is that we're now well into month number three of this correction since the new 52-week highs list peaked back in July. The fact that markets are a mess is not a big deal. The bigger question is more about how long it will take to resolve, and which stocks are holding up the best during this seasonally weak period. Today I want to focus on a space that is acting way better than the rest of its peers: Cyber Security. While Tech stocks have generally been struggling since mid-summer, take a look at Palo Alto Networks, Inc. (PANW) hanging in there just fine:

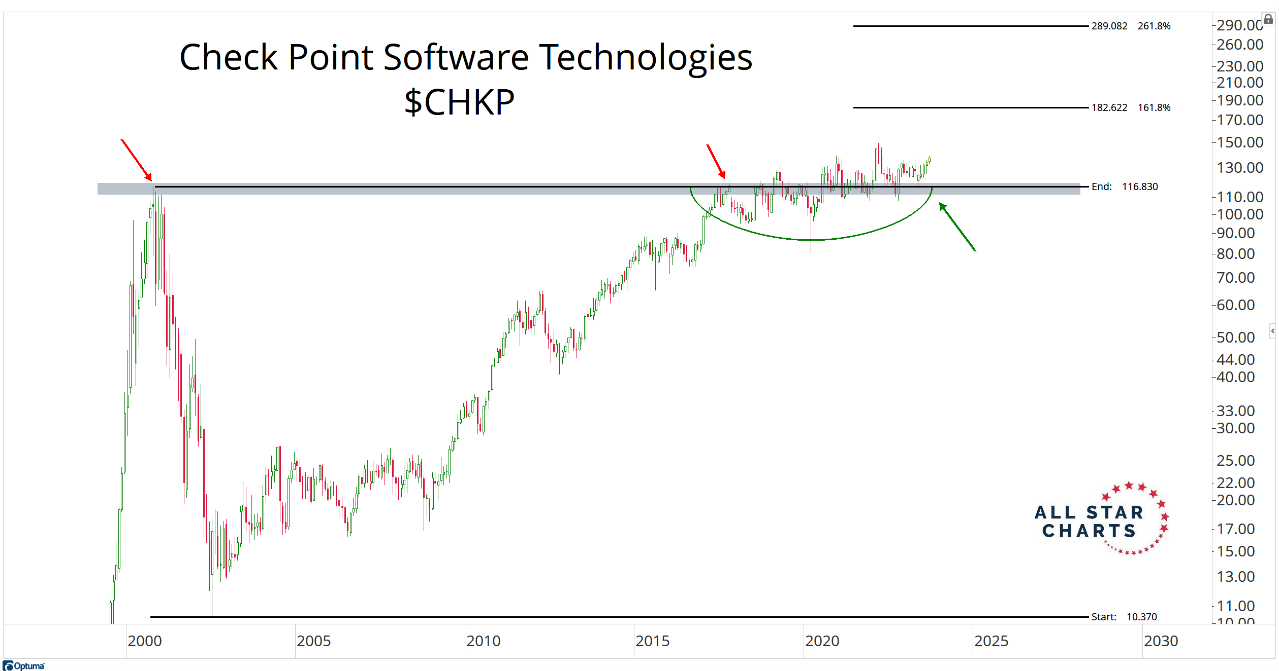

Palo Alto is actually up during this market correction. What does that say about the demand for PANW? What does that suggest for Cyber Security in general? Take a look at Check Point Software Technologies Ltd. (CHKP), a stock that has made little progress in over 20 years, if you zoom out. But off the post-Tech bubble lows, it's been a steady uptrend. And it's just now starting to get going:

Check Point is up almost 9% since the new highs list peaked in July, and the majority of stocks have corrected. One thing about market corrections is that it drives investors nuts. You can see the crazy oozing out of people on the twitter. And you see it in the headlines too.

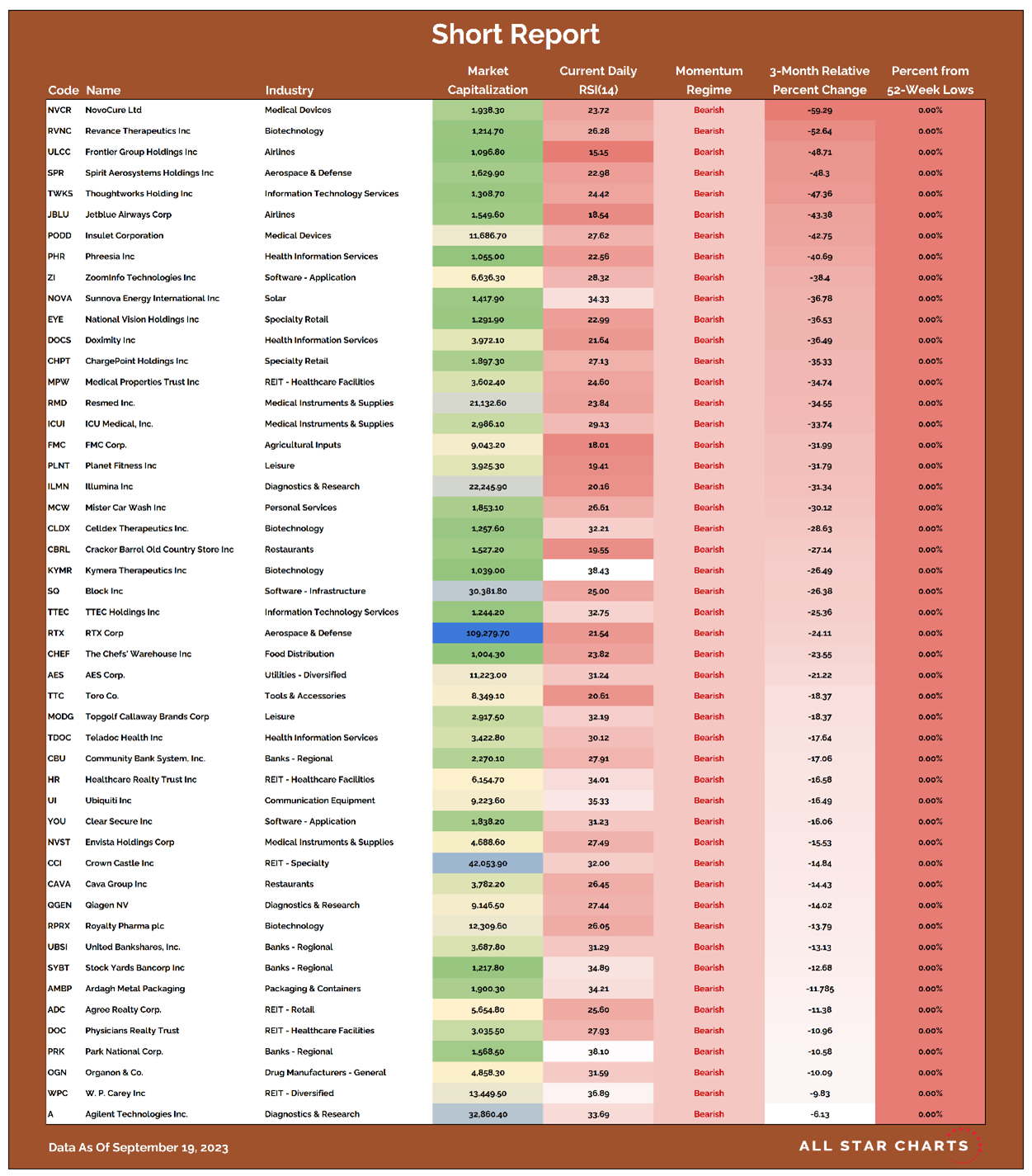

But in my experience, it's way better to just focus on how normal this is around this time of the year. And more importantly, pay attention to which stocks are bucking the trend. But remember, it's not just about looking for relative strength. There are a lot of stocks that look terrible too. Here's our list of the worst stocks on the planet:

These are stocks that were already struggling before this market correction. Which ones are you shorting? Which ones are you looking to short? Are any names on this list worth buying down here? It goes both ways!

To learn more about JC Parets, please visit AllStarCharts.com.