The majority of stocks have struggled to make any progress during what is historically a time when stocks struggle states JC Parets of AllStarCharts.com.

As I said many times last quarter, if the market was not behaving the way it currently is, then that would be very unusual. We recently discussed what we're doing about the current market environment and what the market would have to do to force us to change our strategy. The overwhelming theme continues to be prices stuck below overhead supply.

When you go sector by sector, bellwether by bellwether, you'll quickly notice the same thing—all below proven levels of resistance. Look at Technology, representing almost 30% of the S&P500, failing at the same prices it failed in late 2021:

Then look at Industrials, which historically have the highest correlation with the S&P500 of all the sectors—same thing, stuck below its 2021 highs:

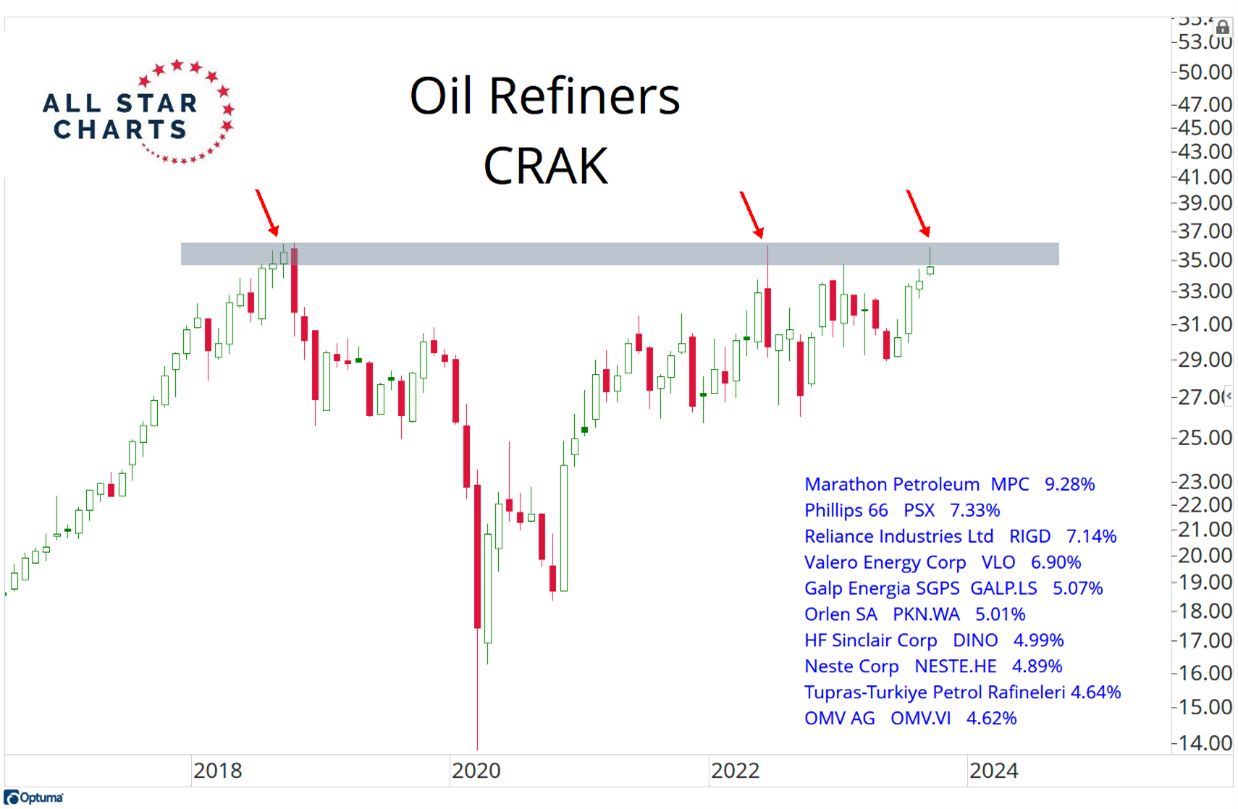

And even in the more recent leadership groups, look at Oil Refiners also stuck below its former highs:

Go stock by stock, sector by sector, and see for yourself. How long will it take for demand to absorb all this overhead supply? Let's remember that October is historically a "Bear Killer", where many important market lows have been formed. Will this October be another one? Or will the weakness persist through the end of the year?

To learn more about JC Parets, please visit AllStarCharts.com.