Risk-off sentiment has returned to markets with a vengeance as economic and political developments that are less than conducive to higher stock prices keep rolling in, states Ian Murphy of MurphyTrading.com.

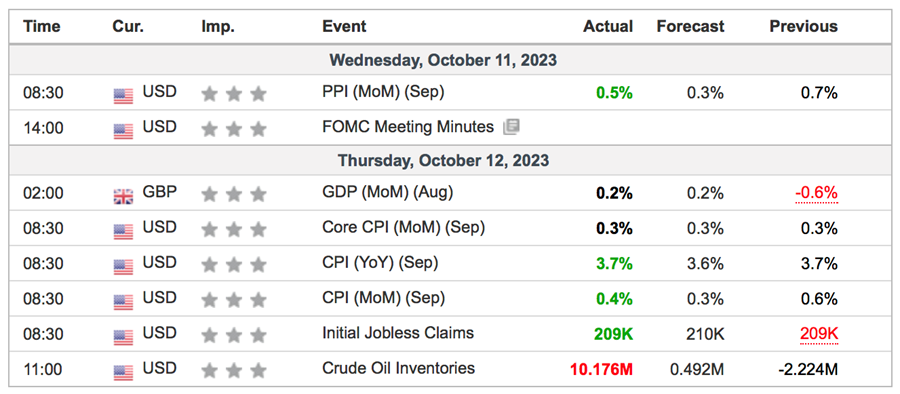

Consumer prices in China remained as flat as a pancake in September while the government is towing with the idea of creating a fund to shore up the ailing stock market. Meanwhile, in the US, prices at the till keep climbing as evidenced by yesterday’s CPI numbers (above) which came in higher than expected. Stocks and treasuries sold off abruptly on the news as interest rates are expected to remain elevated for some time to come.

Source: www.investing.com

On the political front, Israel is preparing for a ground offensive while Iran stated it may not stay on the sidelines if the conflict intensifies, and all the while, the war in Ukraine rumbles on. Also, the Republicans failed to elect a house speaker yesterday, which is adding to the growing uncertainty for traders and investors as we head into a weekend that begins on Friday 13.

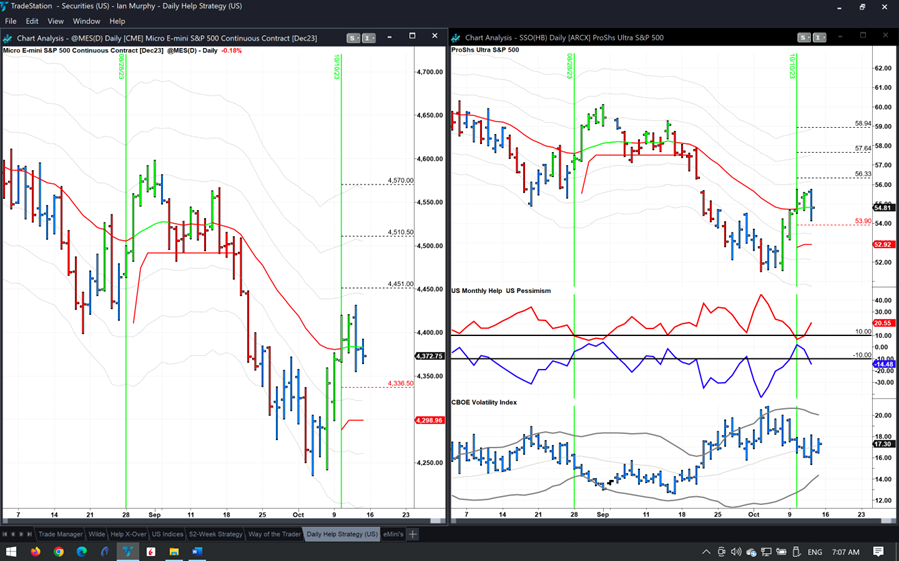

The live Help Strategy trigger was close to being stopped during yesterday’s sharp pullback in equities but managed to hang in there for another day - which might be today!

Finally, our old and always reliable friend, the Composite Help indicator failed to get above zero in the recent rally on the S&P 500 (SPX), never a good sign - look at the circles above, this is bearish! Also on this daily chart, we have reversed in the face of resistance at the 1ATR line leaving another lower high pattern on the screen (arches).

Learn more about Ian Murphy at MurphyTrading.com.