The chart of the day belongs to the petroleum shipping company Overseas Shipholding (OSG), states Jim Van Meerten of BarChart.com.

I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 8/28 the stock gained 13.21%.

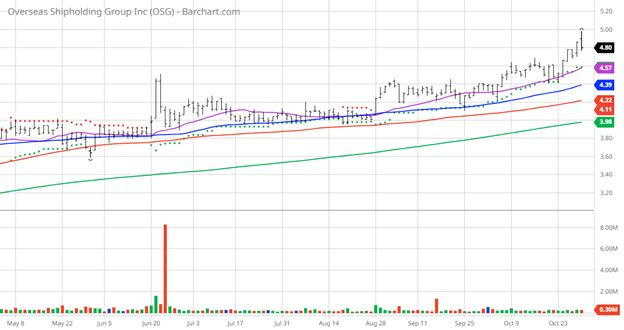

OSG Price vs Daily Moving Averages

Overseas Shipholding Group, Inc., together with its subsidiaries, owns and operates a fleet of oceangoing vessels in the United States. Its vessels are engaged in the transportation of crude oil and petroleum products in the United States flag trade. As of December 31, 2022, the company owned or operated a fleet of 21 vessels totaling an aggregate of approximately 1.5 million deadweight tons. It serves independent oil traders, refinery operators, and the United States and international government entities. Overseas Shipholding Group, Inc. was founded in 1948 and is headquartered in Tampa, Florida.

Barchart Technical Indicators:

- 100% technical buy signals

- 63.65+ Weighted Alpha

- 67.83% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 11 new highs and up 9.34% in the last month

- Relative Strength Index 63.85%

- Technical support level at $4.75

- Recently traded at $4.79 with a 50-day moving average of $4.39

Fundamental Factors:

- Market Cap $372 million

- P/E 8.56

- Not yet followed by Wall Street so there are no Revenue and Earnings projections

Analysts and Investor Sentiment—I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Value Line rates the stock an average of three

- CFRAs MarketScope rates it a strong buy

- 3,410 investors monitor the stock on Seeking Alpha

Additional Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least every week.

Jim Van Meerten had a position in OSG . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.