The bull train has left the station. Institutions are buying stocks again. That means, preparing for more upside. Here’s the best sector set to explode in 2024, states Lucas Downey of Mapsignals.com.

Look, oversold conditions rarely last forever. Eventually, they ignite a ferocious rally. The +6.07% lift in the S&P 500 since October 27th is a case in point. The bigger the dip, the bigger the rip. While pundits squabble over the market’s next-day move, they’re missing the big picture. Money is pouring back into equities. As I’ll show you, we’re well into a risk-on tape. Most stocks are lifting. History points to one elite area of the market primed for the most upside.

Goodbye Oversold Conditions

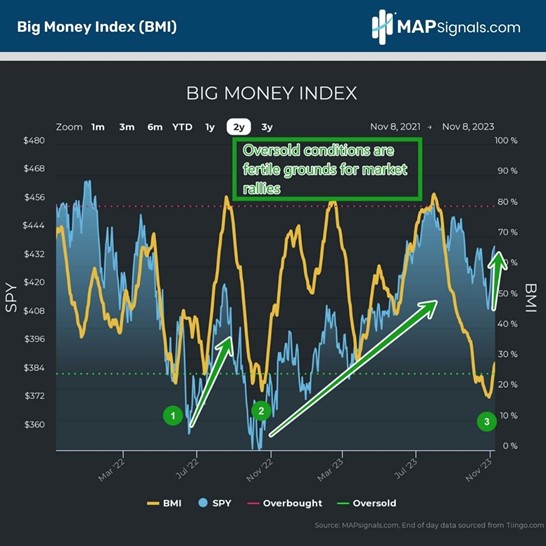

There’s a power law in the stock market: supply and demand. When demand outstrips supply, there’s nowhere for stocks to go but higher. When you measure this activity on thousands of stocks, behavioral changes are easy to spot in real time. Markets went oversold exactly a month ago. My message was simple then: Capitulation will ignite a violent rally. The latest crowd-stunning surge hasn’t disappointed. And it’s backed by real institutional sponsorship. This is evidenced by the climb in the Big Money Index (BMI):

The BMI dipped to an ice-cold level of 17% and now stands at 28%. That’s a staggering move. Shorts are getting squeezed. Unfortunately for the bears, their beating is only beginning. High-quality stocks are getting scooped up… Technology outliers. These are best-in-class companies that grow their sales and earnings year after year. When money is pouring into outstanding firms, you can bet that the rally is real. Get this, since the October 27th low, 27% of all stocks bought in our data are Technology names. Check it out:

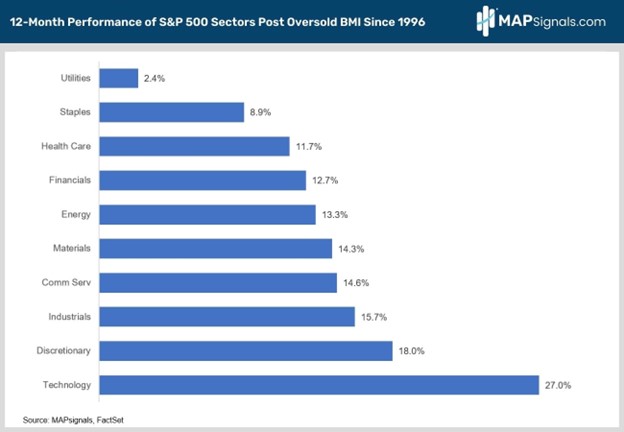

This concentration may surprise you. But when you study history, this is a recurring theme. Technology is the Best Sector to Explode in 2024. It’s one thing to measure what’s happening now. It’s another to study historical evidence. The latter holds greater weight. We’ve recently vaulted out of oversold conditions. I went back and studied all oversold periods and culled together all 12-month sector returns post these rare events. Since 1996, Technology stocks have been the clear run-away outperformer after reaching the green zone. On average, the Tech group surges 27% a year later:

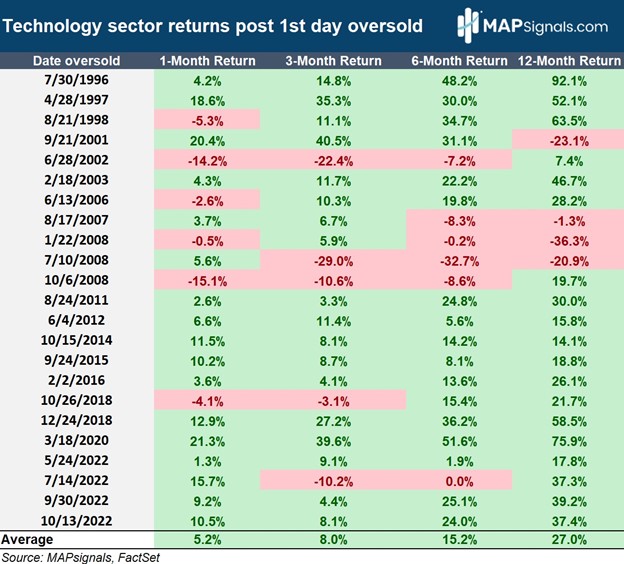

Looking above, it’s not even close. Betting on technology has been the winning ticket. And it’s not just the 12-month gains that are notable. Below displays the one, three, six, and 12-month returns after each oversold instance for the Technology sector. A month later the group surged 5.2%. Three-month gains ramp to 8%. 6-month returns stand at 15.2%:

One word comes to mind: JUICE! Putting it all together, the best sector to explode in 2024 is Technology. If you’ve followed my advice and nibbled at stocks the last few weeks, AWESOME! With this powerful study, it’s likely time to take a bigger bite. And that’s where MAPsignals shines. The new leaders are here in the Technology space. The train has left the station—hop on board or get left behind.

Let’s wrap up.

Here’s the bottom line: Oversold came and went. New leadership is emerging in the Technology space. When you study history, this theme has a lot further to go. The Technology sector surged an average of 27% after an oversold Big Money Index. The evidence says it’s the best sector to explode in 2024.

To learn more about Lucas Downey, visit Mapsignals.com.