It's odd because we're in the middle of a raging bull market, but it feels that almost no one is participating in it, states JC Parets of AllStarCharts.com.

Just look around. Over the past 18 months, people have told me how crazy I am for buying stocks. But you know, it's been really rewarding buying stocks. It's the selling of stocks that has generally not worked out very well for investors. But what do we do now, as we enter the early stages of the most bullish time of the year?

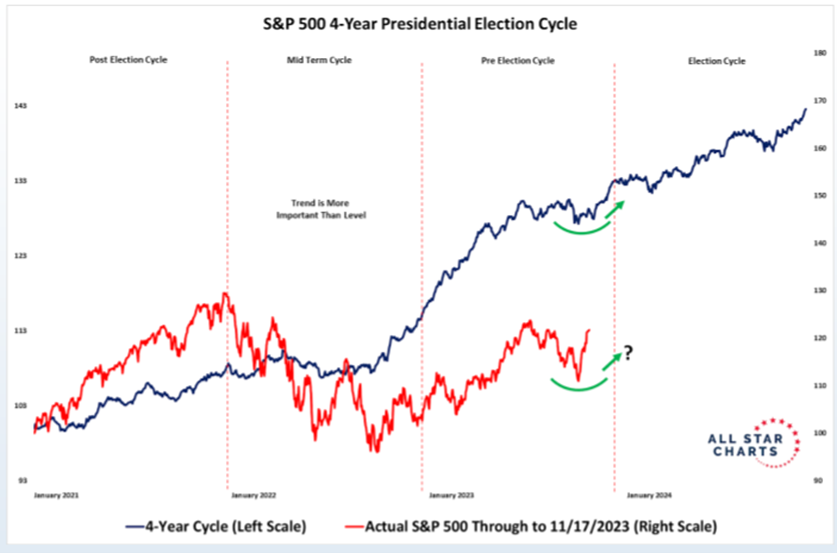

November through January is historically the most bullish three-month period of the entire year. It also marks the beginning of the most bullish 6-month period of the year. Take a look at the entire four-year cycle. This is historically where stocks start to do well. And wouldn't you know it, stocks are doing really well.

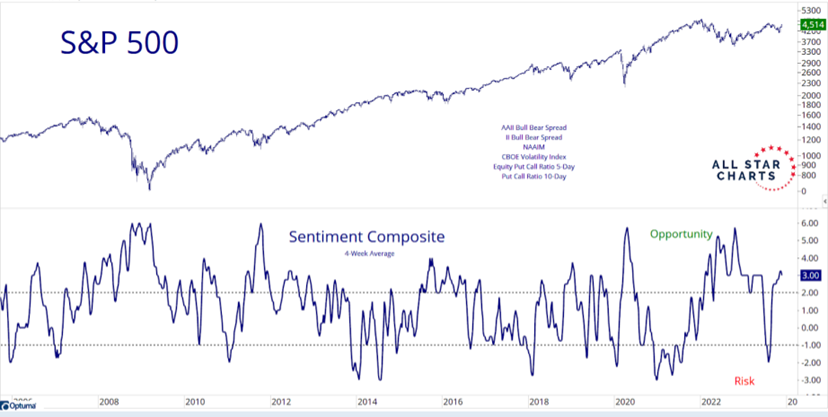

What continues to be surprising is just how pessimistic everyone is. It's tough to quantify sentiment because there are so many different readings, polls, and indicators. So we create a composite of a bunch of different indicators to approach sentiment from a weight-of-the-evidence perspective. And as you can see, there is somehow more opportunity right now (too much pessimism) than there is risk (too much optimism):

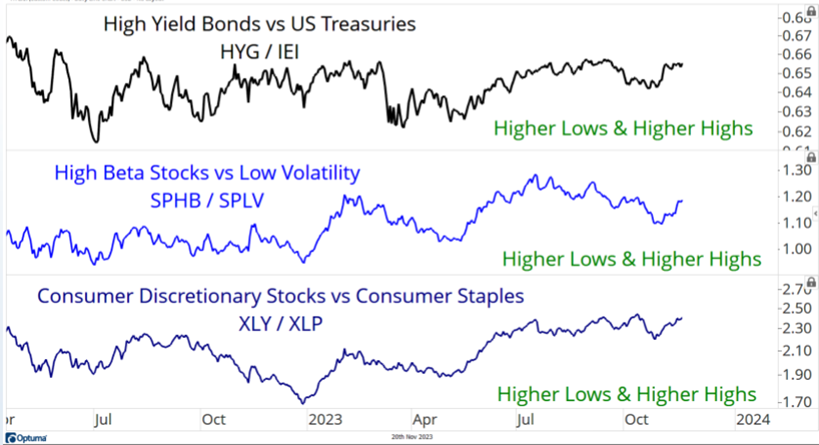

And from an Intermarket perspective, all signs continue to point towards a healthy market environment. Look down here below. Credit spreads are as tight as they've been all year. High Beta keeps making higher highs and higher lows vs Low Volatility, and Discretionary stocks continue to outpace Staples:

Contrary to popular belief, it's not just seven stocks that are going up. In fact, it's not just the United States that is working. Do you see this new Argentinian President? This guy is wild. Take some time out of your day to watch some of his videos. It's worth a few minutes to get a good laugh. Here's the Argentina ETF breaking out of a multi-year base:

Of course, it's hard to have a real conversation about Argentina, or Latin America in general, without bringing up MercadoLibre (MELI). This is like if Amazon and eBay had a baby in Argentina but it lived in Uruguay for some reason. $MELI has a $75 Billion market cap and if it's above 1300 we want to stay long with a target up near 2000.

To learn more about JC Parets, please visit AllStarCharts.com.