Remember when they told you Black Monday was coming, asks JC Parets of AllStarCharts.com.

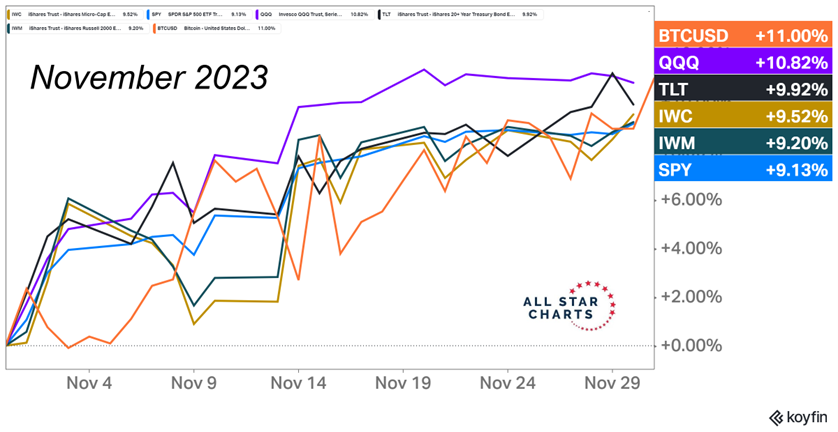

Remember how the yield curve was the greatest indicator of recessions and bear markets ever? How about that time they told you a war was a bad thing for stocks? The best one was how they told you that market breadth was weak. "It's only seven stocks, JC", lol. None of the people telling you these things actually took the time to count how many stocks were going up. If they had, then they wouldn't have to tell you fairytales about recessions and credit events. As it turns out, November was one of the greatest months in stock market history:

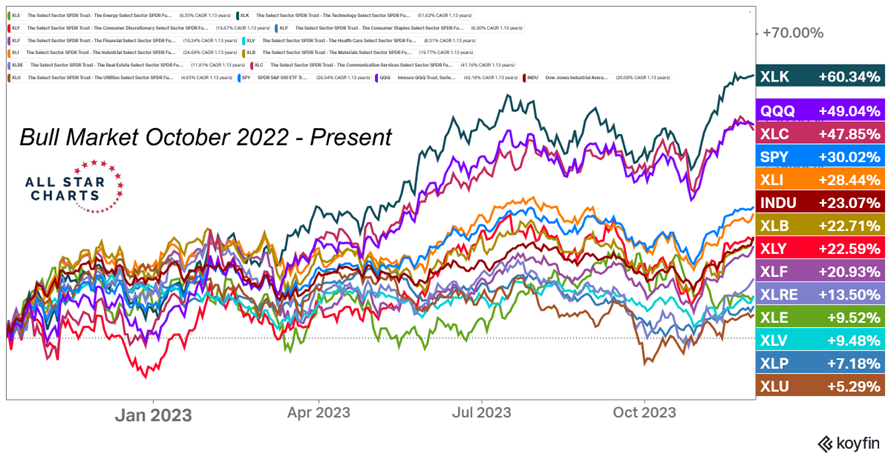

Stocks historically do very well in November. So, I'm not sure why this should be a surprise to anyone. When you go back to last October, when the S&P 500 (SPX) bottomed out, the sector returns are in line with other bull markets in the past.

The types of stocks that tend to lead in bull markets are leading once again in this one: Technology, Consumer discretionary, Industrials, and even Materials and Financials are up over 20% during this period. When you go back and study bull markets, you'll find that the most defensive areas tend to underperform. And that's exactly what we're seeing here as Utilities and Consumer Staples are having a hard time keeping up with the rest. All of this is perfectly normal. When you go back and study all the bull markets over the past 100 years, you'll notice how Technology outperforms in almost every single one of them. This time is no different:

Here is Technology (XLK) breaking out to new all-time highs. So, this sets a precedent for other indexes and sectors that have yet to break out above their late 2021 highs. I think the list of stocks and sectors making new all-time highs will continue to get longer into next year.

To learn more about JC Parets, please visit AllStarCharts.com.