A note from Samy over the weekend wondered if the strategies we are following differ from the methods used by professional and institutional traders, states Ian Murphy of MurphyTrading.com.

It depends on the approach being used and the instruments being traded, because institutions are into complex derivatives for short-term trading and retail accounts such as ours do not generally have access to those products. But when it comes to stocks, ETFs, and futures they are using the same methods as us.

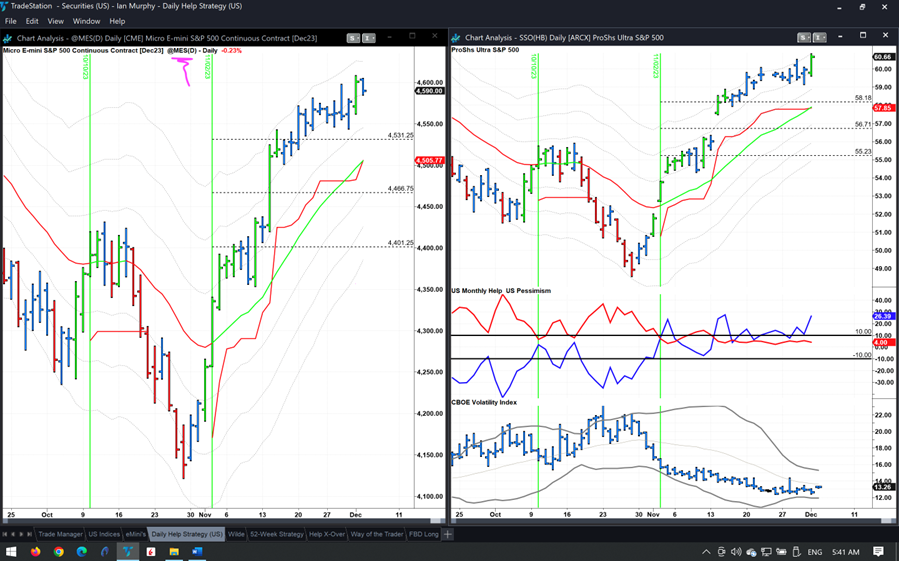

For example, our Help Strategy which catches a market bounce is a popular approach used by pros also, but they will probably (but not always) use the full E-mini futures contracts (@ES) as opposed to the smaller Micro E-Minis (@MES) which are shown on the left chart above. This has to do with the size and liquidity of the contracts rather than the method which is the same.

Pros and institutions will make use of the heavy leverage offered with these products to get more bang for their buck—or should I say, ‘their client’s buck’, because that’s another difference between us, they are more likely to be using someone else’s money to trade. Institutional traders also tend to be more aware of risk management limits because their accounts are overseen by managers, a benefit we do not have!

Learn more about Ian Murphy at MurphyTrading.com.