For today’s Trade of the Day e-letter we will be looking at a monthly chart for Toll Brothers, Inc. (TOL), states Chuck Hughes of Hughes Optioneering.

Before breaking down TOL’s monthly chart let’s first review what products and services the company offers. Toll Brothers, Inc., together with its subsidiaries, designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States. It also designs, builds, markets, and sells condominiums through Toll Brothers City Living. In addition, the company develops a range of single-story living and first-floor primary bedroom suite home designs, as well as communities with recreational amenities, such as golf courses, marinas, pool complexes, country clubs, and fitness and recreation centers.

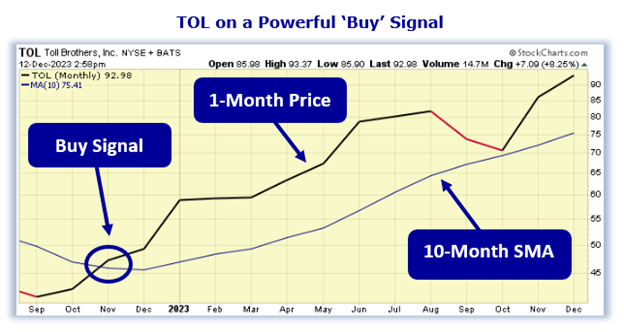

Now, let’s begin to break down the monthly chart for TOL stock. Below is a Ten-Month Simple Moving Average chart for Toll Brothers, Inc.

Buy TOL Stock

As the chart shows, in November 2022, the TOL one-month Price, crossed above the ten-month simple moving average (SMA). This crossover indicated the buying pressure for TOL stock exceeded the selling pressure. For this kind of crossover to occur, a stock has to be in a strong bullish uptrend. Now, as you can see, the one-month Price is still above the ten-month SMA. That means the bullish trend is still in play! As long as the one-month price remains above the ten-month SMA, the stock is more likely to keep trading at new highs and should be purchased. Our initial price target for TOL is 98.25 per share.

95.9% Profit Potential for TOL Option

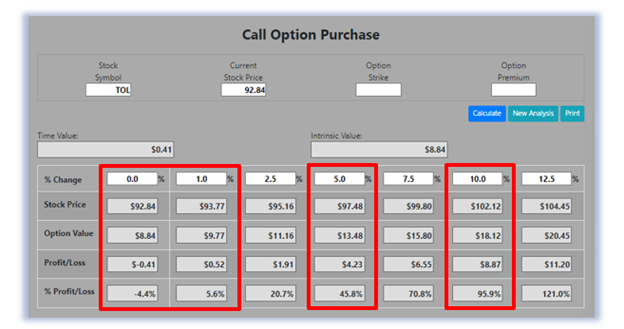

Now, since TOL’s one-month Price is trading above the 10-Month SMA this means the stock’s bullish rally will likely continue. Let’s use the Hughes Optioneering calculator to look at the potential returns for a TOL call option purchase. The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat TOL price to a 12.5% increase.

The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following TOL option example, we used the 1% Rule to select the TOL option strike price but out of fairness to our paid option service subscribers, we don’t list the strike price used in the profit/loss calculation.

Trade with Higher Accuracy

When you use the 1% Rule to select a TOL in-the-money option strike price, TOL stock only has to increase 1% for the option to break even and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying stock closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if TOL stock is flat at 92.84 at option expiration, it will only result in a 4.4% loss for the TOL option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful options trader and can help avoid 100% losses when trading options.

The goal of this example is to demonstrate the powerful profit potential available from trading options compared to stocks. The prices and returns represented below were calculated based on the current stock and option pricing for TOL on 12/12/2023 before commissions. When you purchase a call option, there is no limit on the profit potential of the call if the underlying stock continues to move up in price.

For this specific call option, the calculator analysis below reveals if TOL stock increases 5.0% at option expiration to 97.48 (circled), the call option would make 45.8% before the commission. If TOL stock increases 10.0% at option expiration to 102.12 (circled), the call option would make 95.9% before the commission and outperform the stock return by nearly ten to one. The leverage provided by call options allows you to maximize potential returns on bullish stocks. The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.