As we head into the final furlong of the trading year that was 2023, the Help Strategy has yet again pulled off a home run at the eleventh hour, states Ian Murphy of MurphyTrading.com.

The current trade triggered a gap up on November second, four days after the S&P 500 (SPX) bottomed out, and has not looked back since. Admittedly US equities paused for breath at the beginning of December and flattened out for a while, but that’s to be expected after such a buoyant bullish bounce. Last week’s Fed announcement and follow-up news conference were perceived as dovish, giving bulls just the excuse they needed to surge upwards again.

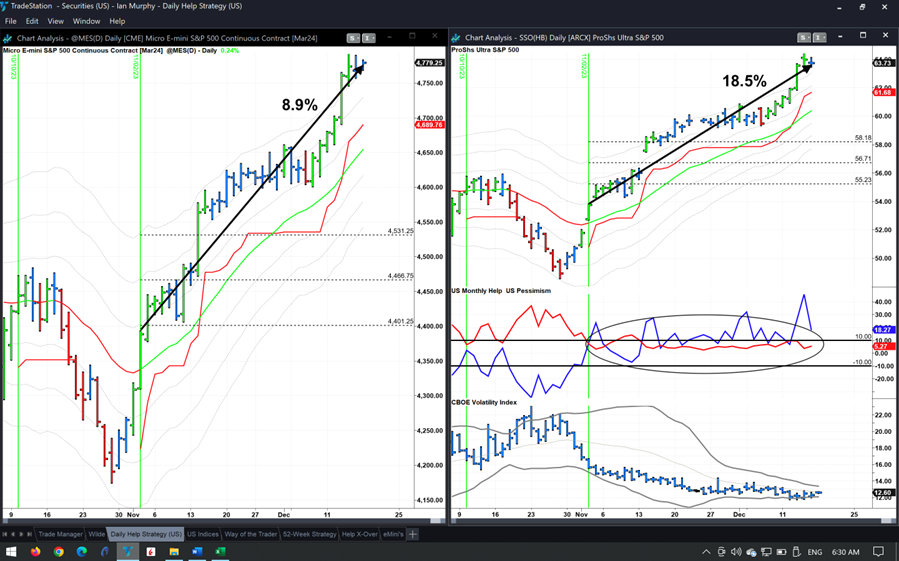

As of 06:30 ET, Micro E-mini futures of the S&P 500 are up 8.9% (excluding the magnifying power of gearing) while the 2x geared ETF from ProShares (SSO) is green to the tune of 18.5%, with 14.7% locked in on the trailing protective stop.

Considering the average return on the S&P 500 over the past few decades is 11-12% per year (depending on how you count), that’s not a bad way to end a year that had a negative first quarter and faced macroeconomic headwinds as the months progressed.

As always, keep an eye on the Pessimism indicator (circled), because that will start to rise before the market starts to pull back.

Learn more about Ian Murphy at MurphyTrading.com.