The EUR/USD has been struggling but still largely edging higher in recent times, as it looks to finish the month and year in the positive territory, states Fawad Razaqzada of Trading Candles.

At the time of writing, the single currency was up about 2.3% against the dollar in 2023, in what has been a largely unexciting year for the EUR/USD traders. It posted small gains in Q1 and Q2, before falling sharply in Q3. So far in Q4, it has made back a good chunk of those losses to hold in the positive territory, but still well below the year’s high of 1.12375 hit in July. Consistently poor economic data from the Eurozone has prevented the single currency from staging a more meaningful recovery, but it nevertheless looked set to avoid a hattrick of yearly losses.

Can EUR/USD Extend Its Recovery?

Supported largely by a positive tone across financial markets and a falling US dollar, the EUR/USD could further extend its recovery in the early parts of 2024 should we now see more weakness creep into US data, as that will encourage the Fed to cut rates sooner and more forcefully than anticipated. Recent data pointers from the US have largely surprised to the upside, casting doubts over expectations that the world’s largest economy is about to fall into a recession. It has weathered the impact of high inflation and rising interest rates much better than most other parts of the world. But the Fed has signaled interest rates will be cut a few times next year and the market has responded by pushing bond yields and the dollar lower accordingly. If more signs emerge that the US economy is weakening, then that could further weigh on bond yields and underpin risk assets, including the EUR/USD.

The key risk for the EUR/USD therefore is if the dollar becomes stronger due to further signs of resilience in the US economy. In this scenario, bond yields might not fall as much, supporting the appeal of fixed income and undercutting the upside potential of the EUR/USD.

On the other side of the EUR/USD equation, support for the single currency has been provided by the ECB pushing back against bets on imminent cuts to interest rates. On Thursday of last week, the central bank reaffirmed that rates would remain at record highs despite lower inflation expectations. ECB President Christine Lagarde warned inflation could soon rebound, adding "We don't think that it's time to lower our guard" and that "there is still work to be done.”

EUR/USD Technical Analysis

Source: TradingView.com

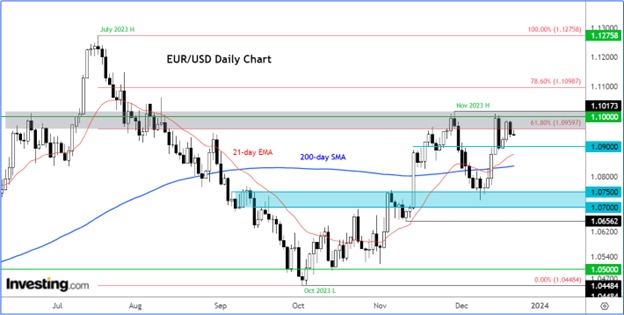

Despite some signs of weakness and its inability to break cleanly above the 1.10 area, the EUR/USD’s underlying trend remains bullish. Objective indicators like moving averages tell us that rates have been trending positively. On the chart, you can see that the shorter-term 21-day exponential average has recently crossed above the 200-day simple average. These moving averages have positive slopes and are both residing below current levels. What’s more, the EUR/USD was holding in the positive territory on the month at the time of writing. In November, it closed up nearly 3% higher, forming a three-bar reversal pattern on the monthly time frame. Furthermore, ever since the EUR/USD bottomed in October at just below 1.0450, you can easily observe higher lows on this daily chart.

Against this technical backdrop, I am not entertaining the idea of shorting the EUR/USD until the charts tell us otherwise. Dip-buying has been the go-to strategy, so it pays more to pay closer attention to bullish signals near support than to get overly excited over shorter-term bearish signals. Indeed, technical signals that have suggested rates have topped, like last Friday’s large bearish candle, have so far failed to lead to any significant downside follow-through. That candle has probably trapped and frustrated a few traders.

To learn more about Fawad Razaqzada visit TradingCandles.com