With the shortest day of the year in the northern hemisphere behind us, things can only get brighter from here on out. At least that’s what the planets are telling us, but unfortunately, the S&P 500 (SPX) didn’t get the memo, exclaims Ian Murphy of MurphyTrading.com.

Some are blaming zero-day options for Wednesday’s sharp decline in US equities, others are pointing to the poor earnings from FedEx which is considered an early warning signal for declining economic activity. Either way, stocks recovered at least half the selloff in yesterday’s session.

On Wednesday we looked at the open trade in the 52-Week Strategy, today it’s the turn of the Help Strategy as markets wind down this afternoon for the Christmas break.

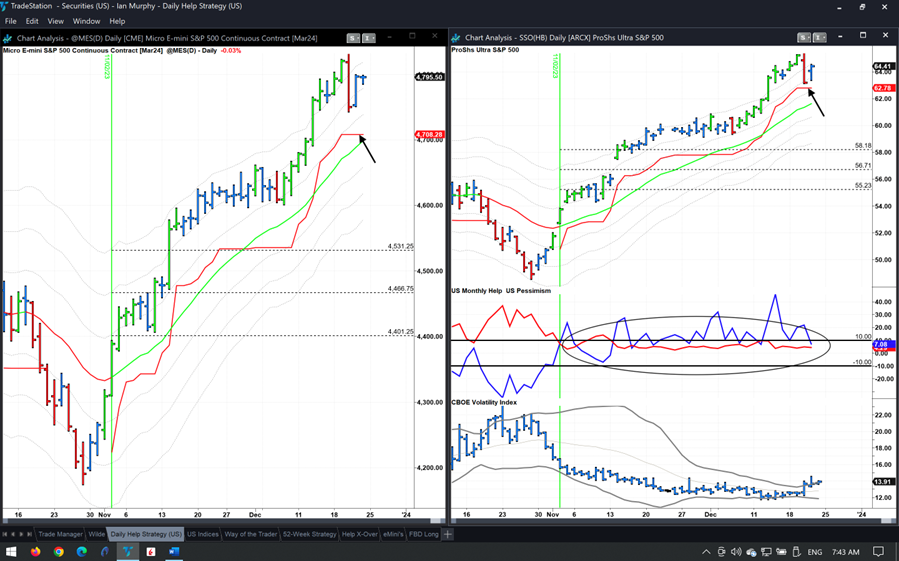

The trailing stop has flatlined at $62.78 on SSO and 4708.28 on Micro E-minis (arrows), and neither was touched in Wednesday’s sharp decline. The best-case scenario from here is a recovery today which continues when markets open again on Tuesday, barring that, a controlled decline that triggers the stop during a session is preferable. The good news is that the Pessimism Indicator remains below 10% (circled).

I wish you a Peaceful and Happy Christmas!🎄

Learn more about Ian Murphy at MurphyTrading.com.