In 2023, BCI introduced the CEO Strategy, a streamlined approach to covered call writing using the Select Sector SPDRs, states Alan Ellman of The Blue Collar Investor.

This article will explain why sector rotation in our business cycle will create opportunities for this strategy to beat the market consistently. First, some definitions.

What is the CEO Strategy?

This is an acronym for Combining Exchange-Traded Funds with Stock Options. The database of over 8000 securities is reduced to 11 and the number of exit strategies available for covered call writing is reduced from 14 to four. Each month or week, we select the top four or five to populate our covered call writing portfolios.

What are the Select Sector SPDRs?

These are exchange-traded funds (ETFs) that divided the S&P 500 into 11 index funds and managed to match the price and yield performance of their underlying sector indexes. Historically, these sectors will out- or underperform depending on the stage of the current business cycle in our economy.

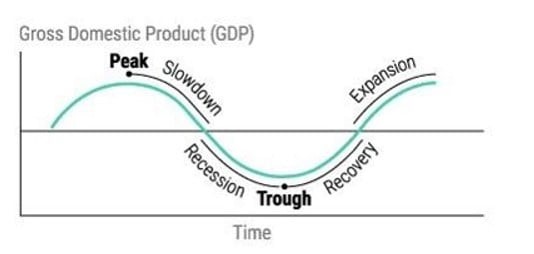

What is the Business Cycle?

Fluctuations in Gross Domestic Product (GDP) explain the expansion and contraction of economic activity that an economy experiences over time.

Top-Performing Select Sector SPDRs During Each Phase of the Business Cycle Reflecting Sector Rotation

Recession:

- XLP: Consumer staples

- XLU: Utilities

- XLV: Health Care

Recovery:

- XLRE: Real Estate

- XLY: Consumer Discretionary

- XLB: Materials

Expansion:

- XLK: Technology

- XLF: Financials

- XLRE: Real Estate

Slowdown:

- XLV: Health Care

- XLP: Consumer Staples

- XLF: Financials

Discussion

Selecting our best-performing Select Sector SPDR ETFs each week or month allows our portfolios to become populated with securities that align with the current business cycle. Although there are no guarantees, this does enhance our opportunities to beat the market consistently especially while we lower our cost basis when selling covered call options.

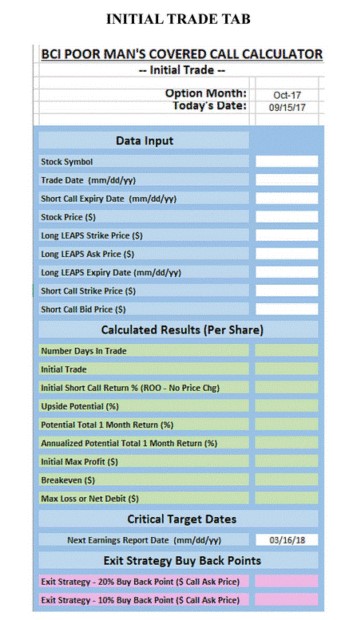

Poor Man’s Covered Call Calculator

The PMCC Calculator is designed to determine initial trade structure and status as well as various position management price point considerations and the exit strategy price buyback points to buy back the short calls based on the 20%/10% guidelines detailed in the BCI books and Online Video Programs. The spreadsheet comes with a user guide.

Cells are provided to enter the option month and current date, used to assist with the calculations. There are five tabs incorporated into this calculator. The image above shows the first tab for trade initialization.

Learn more about Alan Ellman on the Blue Collar Investor Website.