Shares in Boeing (BA) and Spirit AeroSystems (SPR) made a rapid descent after the door panel incident on the Alaska Airlines’ 737 Max, states Ian Murphy of MurphyTrading.com.

Sammy emailed yesterday to ask how to manage a position in these stocks if you were long when the news broke. Should you sell immediately, or hold on for a small recovery before selling, or hang in for the long haul? The decision when to exit a position should be made at the same time as the decision to enter because the trading style and strategy we are using dictates the entry and exit criteria. So, an abrupt selloff in a stock should only impact us if a protective stop has been breached. Above all, we should not panic on hearing the news and rush to our trading platform.

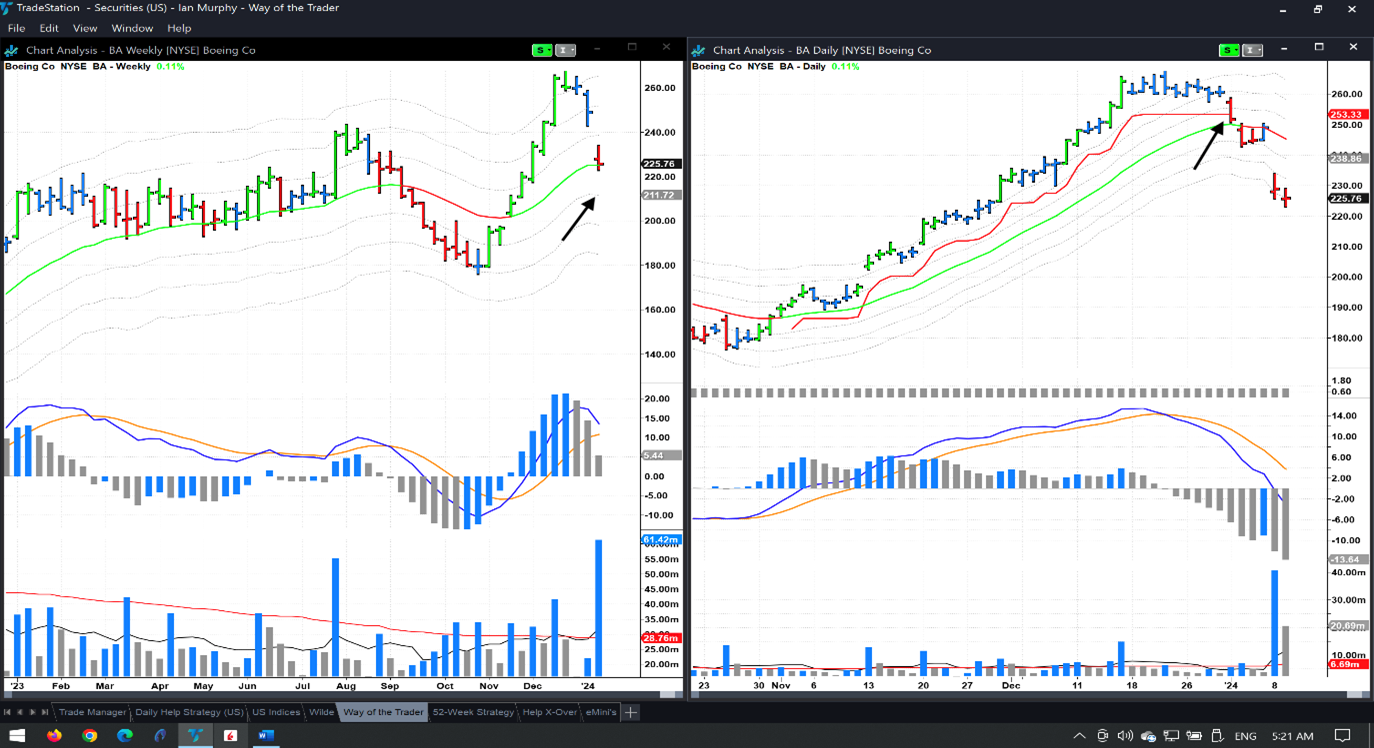

For example, on the charts below imagine the left chart is a weekly trend-following position in Boeing and the right one is a daily hybrid trade that began as a swing and developed into a trend follower.

In both scenarios, there would be nothing to do because the daily trade was already over when we were stopped three days before Monday’s gap down (arrow), and the weekly trend follower is still open as the price has not closed below the -1ATR line (arrow). Simple!

Numerous emails have also come in about the trade ideas to short oil futures and go long on Dominion. Neither trade has required action since the ideas were posted and we will review them on Friday.

Learn more about Ian Murphy at MurphyTrading.com.