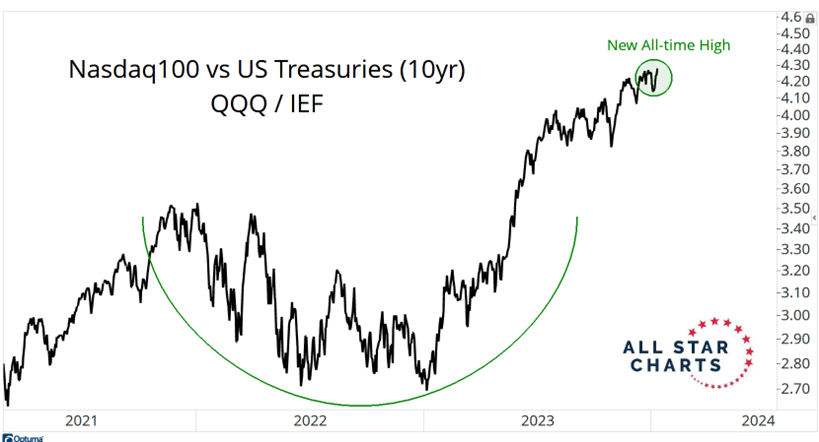

US Treasury Bonds continue to be one of the best ways to underperform during bull markets, states JC Parets of AllStarCharts.com.

Yesterday the Nasdaq100 closed at new all-time highs relative to US Treasuries. In bull markets, the best stocks not only do well on an absolute basis, but they also outperform their alternatives. Treasury Bonds are a good alternative to stocks, of course. Just not during raging bull markets:

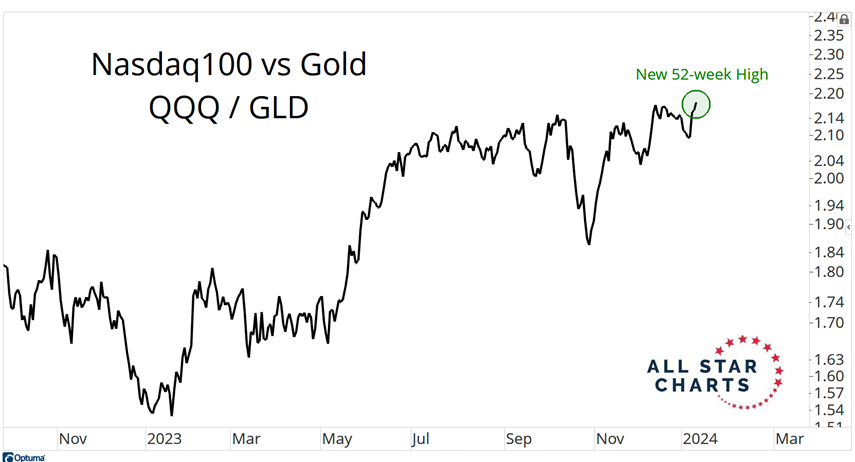

You can see the strength vs Gold as well. While still not at new all-time highs, we're seeing new highs for this bull market. And this market is the only one that matters:

Investors love to fight trends. We see that quite often. In bear markets, they're always looking to pick a bottom. In bull markets, they're always trying to pick a top. The conspiracy theories about the fed "breaking something", whatever that means, were wrong. The lies about an upcoming recession were just that: lies.

The yield curve, the M2, the government shutdowns, the inflation, and all the other ways they tried to keep you from making money in this bull market, were all proven wrong. We still have record cash levels in money market funds just sitting there, underperforming, collecting dust, and just waiting to be put back into equities. Do you want to talk about a tailwind? Investors were positioned very wrong a year ago.

They're still wrong. And that's part of the reason why we think this 18-month-old bull market still has legs. Tell me I'm wrong.

To learn more about JC Parets, please visit AllStarCharts.com.