Earnings season officially kicked off this morning as the big banks revealed how they fared in the last quarter of 2023, with JPMorgan (JPM), Wells Fargo (WFC), and Citigroup (C) reporting before the open, states Ian Murphy of MurphyTrading.com.

Over the coming weeks, the focus among stock market participants will shift from the possibility of rate cuts in the summer to earnings reports, and these should be the principal driver of equity prices.

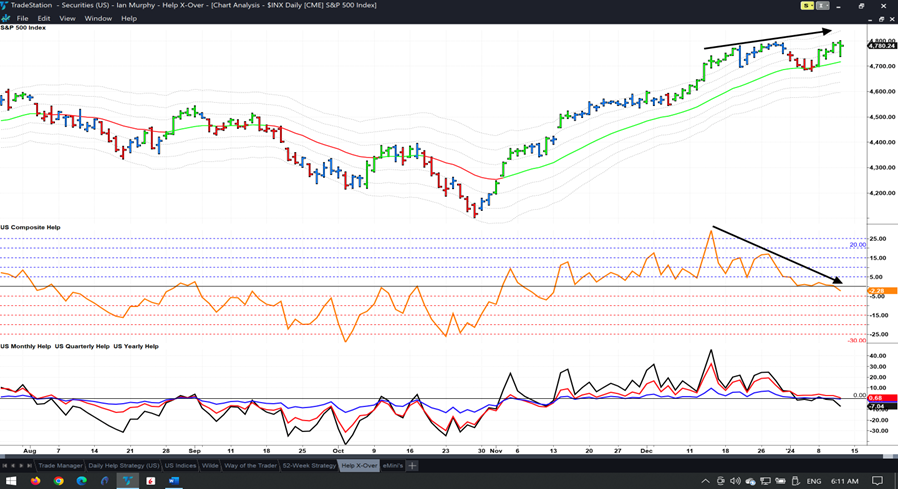

Meanwhile, on the charts, Composite Help, which counts all US stocks making new highs and lows on three time frames has crossed down over the zero line for the first time since November. It has also formed a bearish divergence (arrows), this is never a positive sign. For a quick overview of where the market is going, there is no better indicator, it’s like a cheat sheet for stock traders and investors (check out the videos on the Education page).

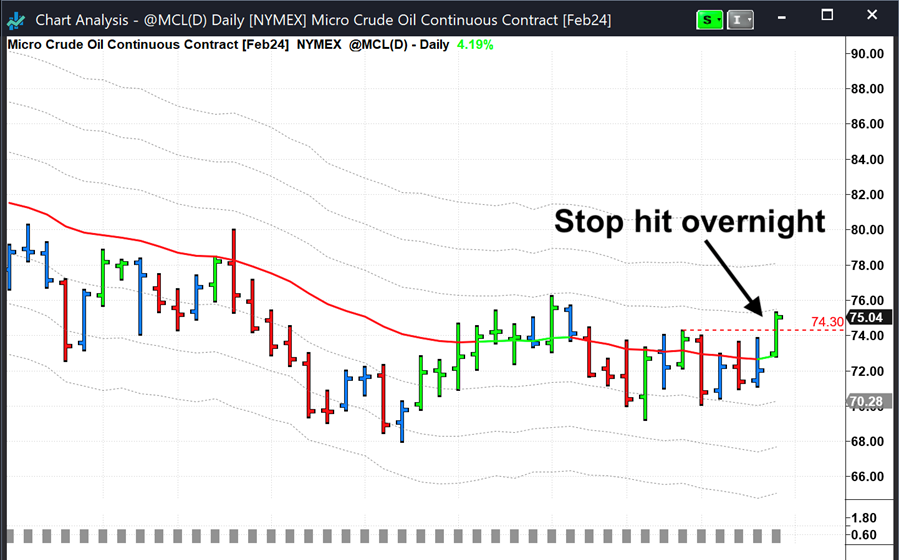

This week’s Trade Idea to short oil with Micro Futures (MCL) has not worked out. Overnight attacks on Houthi targets in Yemen by the US and UK drove prices higher and the initial protective stop was hit almost immediately. This is also one of the reasons I prefer to trade oil futures rather than an ETF such as the United States Oil Fund (USO) because stops will be filled at any time of day, and you are less likely to get a gap down on price at the open of the equity market.

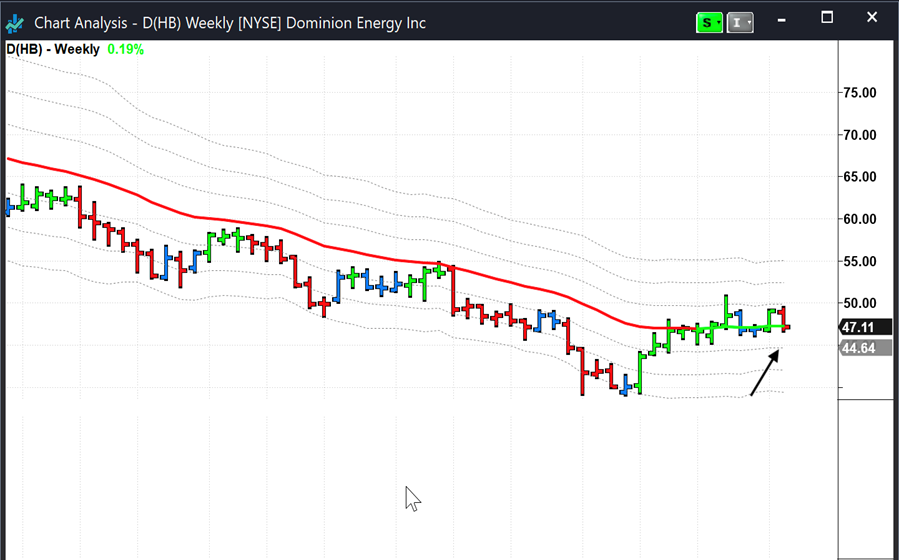

The other open Trade Idea in Dominion Energy, Inc. (D) is doing fine with the soft trailing stop at $44.64 on this weekly trend-following position.

Learn more about Ian Murphy at MurphyTrading.com.