Many Small-caps have been leaders from the very beginning of this bull market, states JC Parets of AllStarCharts.com.

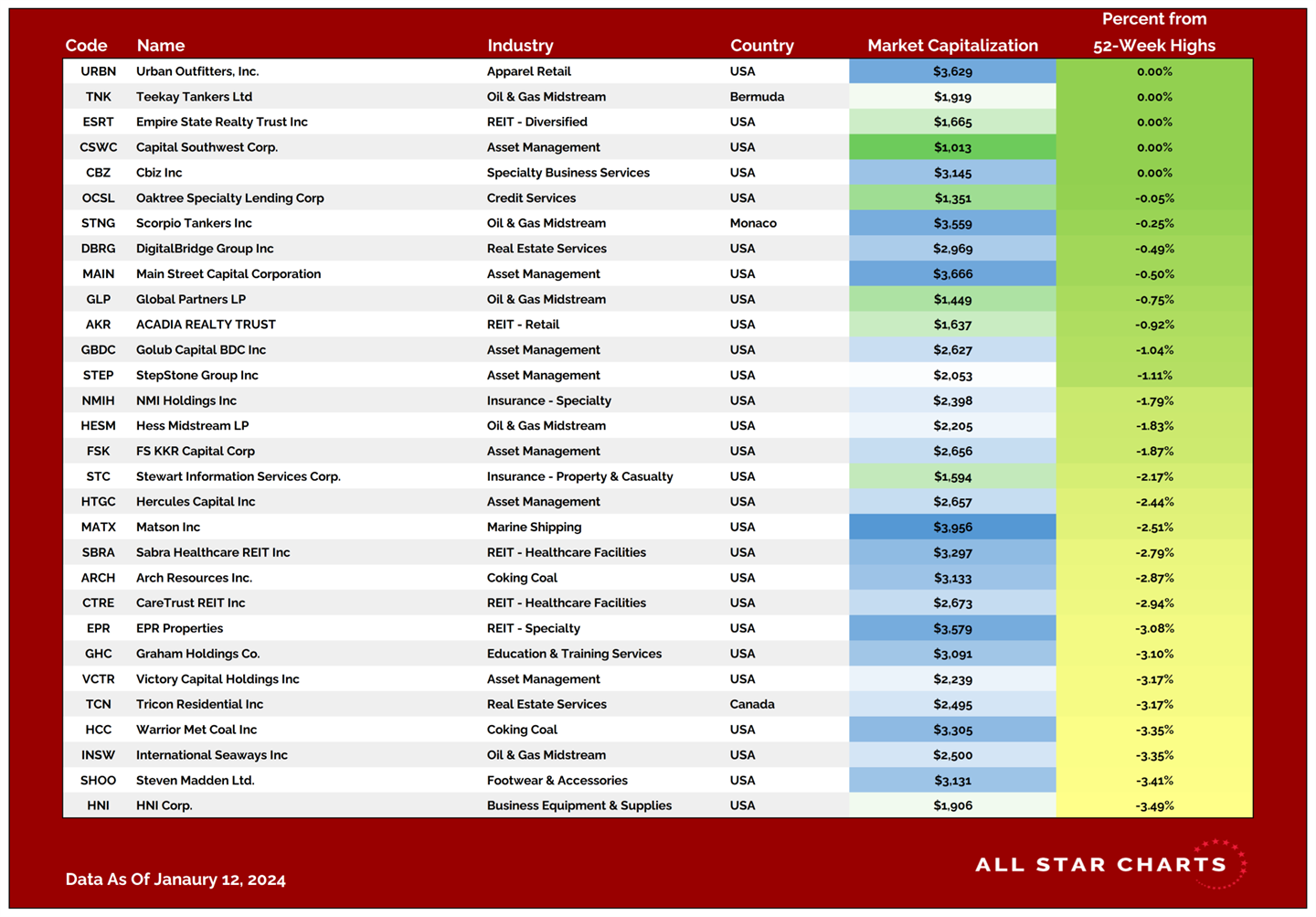

Even though the first couple of weeks of 2024 haven't been great, small-cap Industrials are still up over 42% since the Summer '22 lows. Small-cap Consumer Discretionary is up over 37%. Both of these have outperformed even the S&P500 during this period. So maybe the "Russell2000" has underperformed. But that doesn't mean that "Small-caps" have underperformed. It's on a case-by-case basis. Here is a list of our Minor Leaguers, for example, which include the strongest stocks between $1 Billion - $4 Billion in market cap:

Notice the industry groups on this list. We're looking at Retail stocks, REITs, Asset Managers, Oil & Gas, and other groups that don't get many headlines, especially these days. The markets continue to evolve and sectors keep rotating. It's up to us as investors to be able to adapt. You see investors struggling to do this, especially in the bond market.

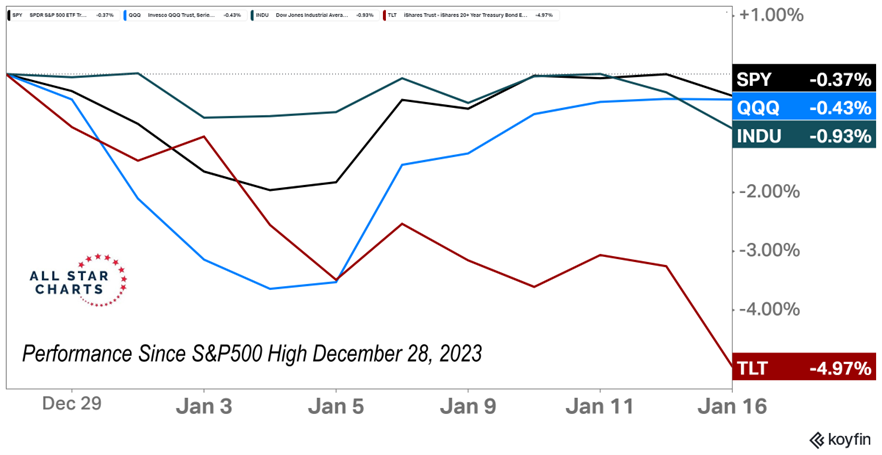

The 60/40 portfolio has been the "100 portfolio" for quite some time now as stocks and bonds have been moving together (60 + 40 = 100). The US Treasury Bond market has NOT acted as a haven. It's been moving with risk assets. You can see so far this year since the S&P500 peaked in late December, the major indexes have been correcting, and the Bond Market has gotten hit even harder.

It's up to us to identify what type of market environment we're in, and then decide which tools and strategies are best for that environment. Most investors completely skip that first part and just try to incorporate their "Strategy" into the market, regardless of the type of environment we're in. That's too hard. I'd rather just play the cards we're dealt instead of pretending we have a certain hand. Play the cards you dealt.

To learn more about JC Parets, please visit AllStarCharts.com.