I wouldn't say that volatility is high, but it is higher than what we've grown accustomed to over the past few months, states JC Parets of AllStarCharts.com.

Tesla (TSLA) has earnings coming up and the animal spirits are out. Traders do not have patience. They are willing to pay a high number to own call options and put options as well. So, we're taking advantage of their poor spending habits and happily accepting their donations. Look at this mess. Can you find me a messier stock?

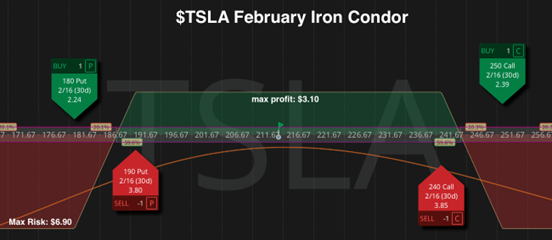

The bet here with Tesla is that this messy stock remains a mess for even longer. We sold the February 240 Call and the February 190 Put. But in this environment, where the US Dollar is behaving this way, we don't feel that comfortable being naked short options.

So, to hedge our strangle here, we bought further out of the money calls and further out of the money puts. We did this ten points beyond the strikes we already sold, to not be exposed to any outsized moves, market-related or earnings-related. This simple trade is called an Iron Condor. We collected $3.10 in total. As soon as we can buy this back for $1.50 we'll go ahead and take our profits.

We already have our resting orders entered. "But JC are you bullish or bearish? Pick one!" Nope. We don't have to. We can leave those choices up to the people making donations. We'll just bet that Tesla stays a mess and those donations end up in our pockets. This is a higher probability of success bet. There are different strategies for different environments. There's a time and a place for everything.

Notice how this trade is very different than the types of trades we've been putting on over the past few months. That's because we're in a slightly different volatility regime. So we're taking advantage of that before word gets out. There are some other changes taking place in this environment, both in the US and around the world.

To learn more about JC Parets, please visit AllStarCharts.com.