Always avoid having an option in place if there is an upcoming earnings report before contract expiration, states Alan Ellman of The Blue Collar Investor

This applies to covered call writing and selling cash-secured puts as it will avoid the risk inherent in the reports. However, once the report passes and any post-report volatility subsides, the underlying security can be utilized in our option-selling strategies if it meets our system criteria. This article will focus on NVIDIA Corporation (NVDA), the after-market 8/23/2023 earnings report, and the opportunities that were presented after the report was made public.

The NVDA Earnings Announcement

On 8/23/2023, after the market closed, NVDA announced earnings that beat market consensus by 31.0%. The stock price moved up the following trading day and option-chains were analyzed for 1-month covered call writing and put-selling post-event opportunities.

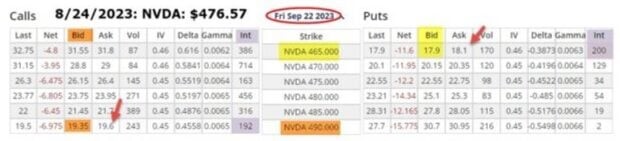

NVDA: Post-Earnings Option-Chain on 8/24/2024 with NVDA Trading at $476.57

- The 9/22/2023 expiration option-chain was evaluated

- The $490.00 OTM call option showed a bid price of $19.35 (aggressive approach)

- The $465.00 OTM put option showed a bid price of $18.10 (defensive approach)

- The purple cells show adequate open-interest liquidity

- The red arrows show reasonable bid-ask spreads

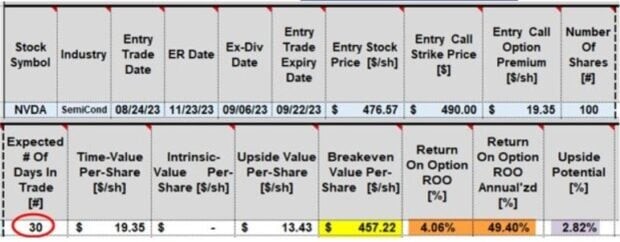

Post-Earnings Initial Call Calculations Using the BCI Trade Management Calculator

- The spreadsheet shows a 30-day trade if taken through contract expiration (circled in red)

- The initial time-value return is 4.06%, 49.40% annualized (brown cells)

- The upside potential from share appreciation is 2.82% (purple cell)

- The breakeven price point is $457.22 (yellow cell)

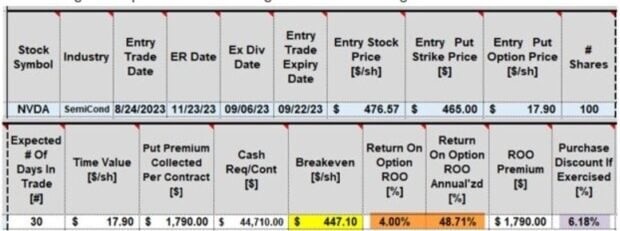

Post-Earnings Initial Put Calculations Using the BCI Trade Management Calculator

- The spreadsheet shows a 30-day trade if taken through contract expiration (bottom left)

- The initial time-value return is 4.00%, 48.71% annualized (brown cells)

- The purchase discount, if exercised is 6.18% (purple cell)

- The breakeven price point is $447.102 (yellow cell)

Learn more about Alan Ellman on the Blue Collar Investor Website.