A great potential trade opportunity just popped up and I wanted to get it to you as quickly as possible. The ticker is ABBV, states Chuck Hughes of Hughes Optioneering.

While it might be tempting to jump in and just go buy shares, I am going to explain why it is a good setup and how options offer a great way to leverage this potential move.

AbbVie (ABBV) has become one of the top-most pharma companies after it acquired Allergan. The deal has transformed AbbVie’s portfolio by lowering its dependence on Humira, its flagship product. AbbVie has one of the most popular cancer drugs in its portfolio, Imbruvica, and its newest immunology drugs Skyrizi and Rinvoq position it well for long-term growth.

Technical Signaling Buy?

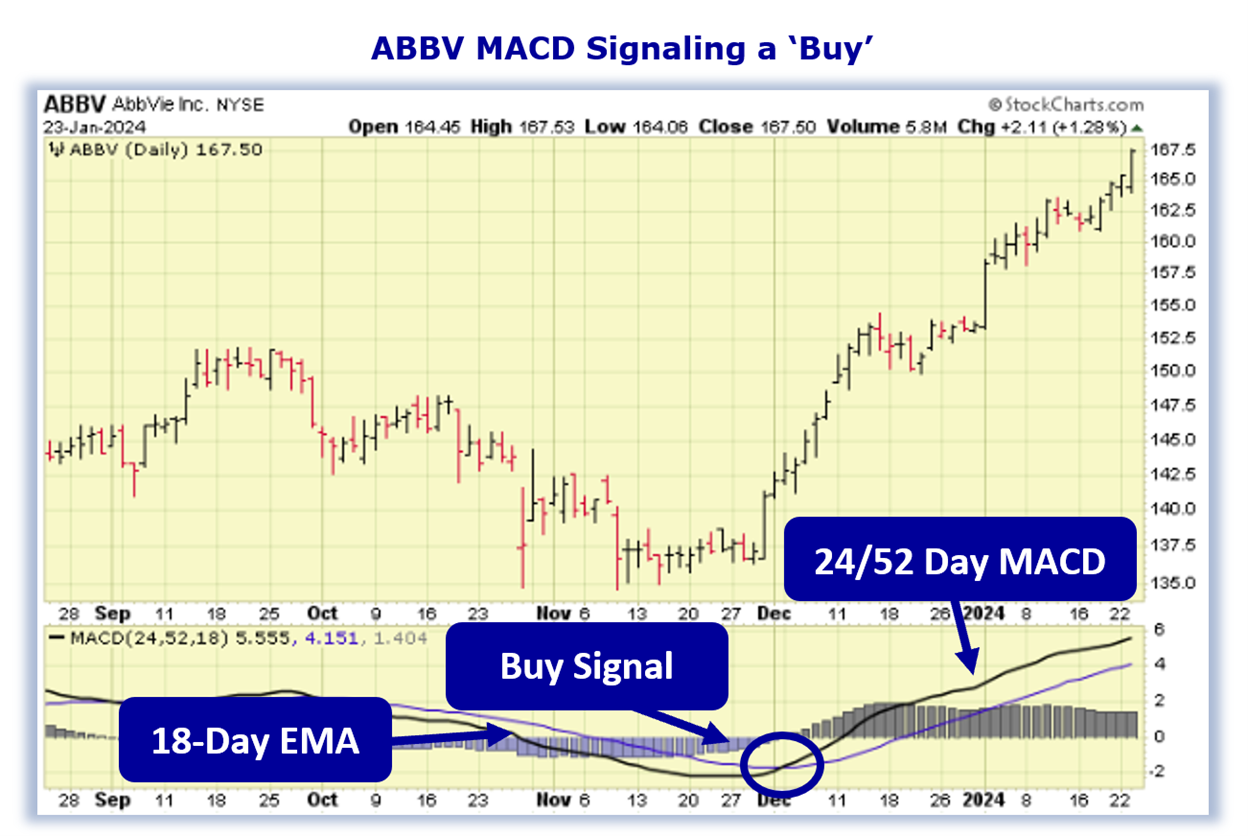

Take a look at the chart below.

ABBV’s 24/52 Day MACD is trading above the 18-Day EMA which is a technical buy signal and it also means the stock’s bullish rally will likely continue. Because of this let’s look at a call option position for ABBV which will allow us to increase the profit potential of our trade.

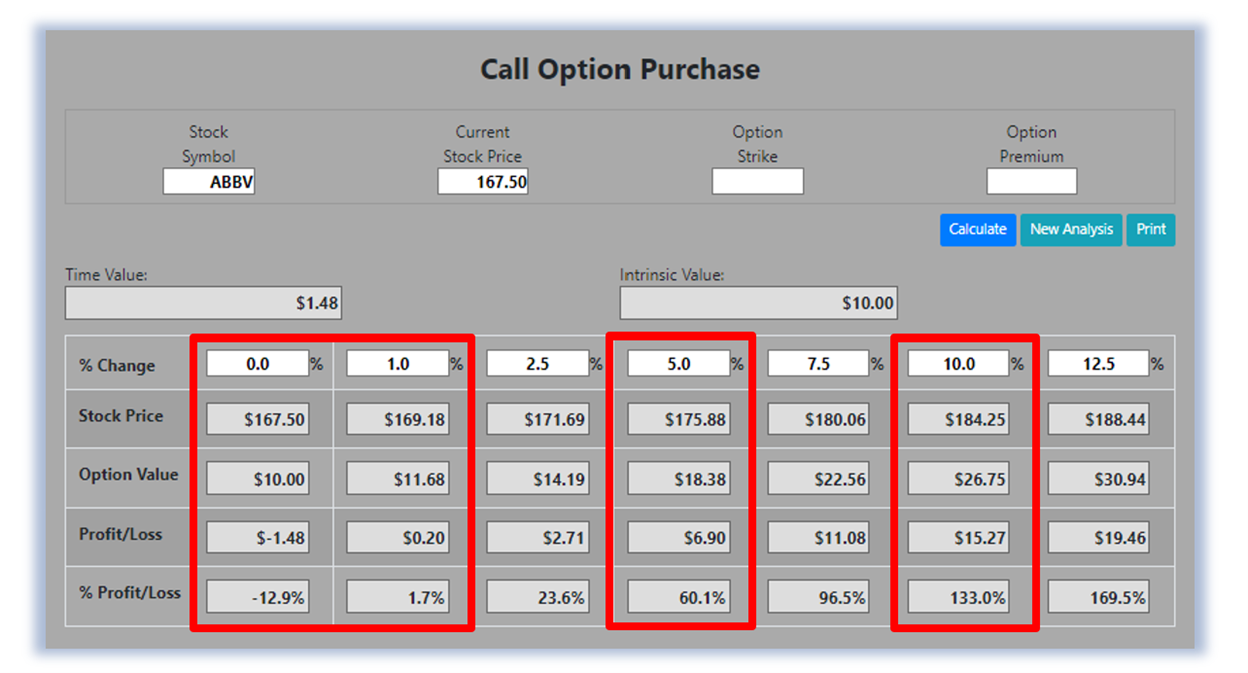

Let’s dive into the trade analysis using our Hughes Optioneering Calculator pictured below.

For this specific call option, the calculator analysis below reveals if ABBV stock increases 5.0% at option expiration to 175.88 (circled), the call option would make 60.1% before the commission. If ABBV stock increases 10.0% at option expiration to 184.25 (circled), the call option would make 133.0% before the commission and outperform the stock return by more than 13 to one. The leverage provided by call options allows you to maximize potential returns on bullish stocks like ABBV.

The prices and returns represented below were calculated based on the current stock and option pricing for ABBV on 1/23/2024 before commissions.

Learn more about Chuck Hughes here.