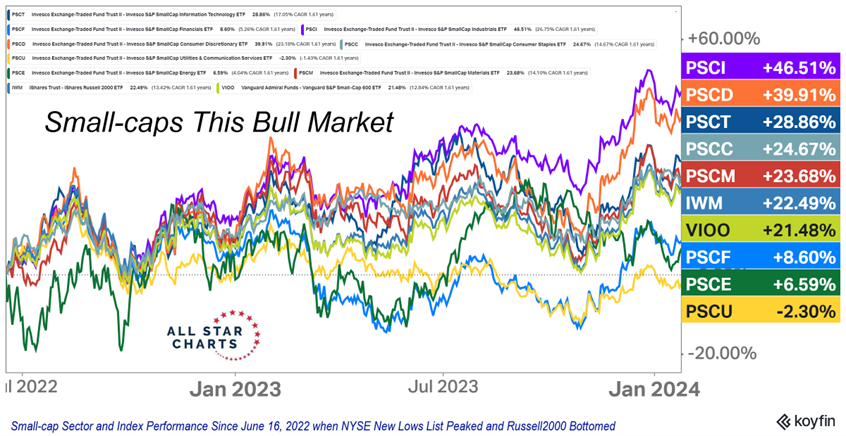

A recent discussion brought up a misconception that small-cap stocks are underperforming, states JC Parets of AllStarCharts.com.

But as it turns out, the most important small-cap stocks are crushing the returns of the major large-cap indexes.

Small-cap Industrials are up over 46% in this bull market. Small-cap Consumer Discretionary is up 40%. And Small-cap Tech is up almost 30%. The thing to remember is that there are 250 biotech stocks in the Russell 2000. You also have another 250 or so regional banks in the index.

So if you're going to make all your life decisions based on an index made up of 25% regional banks and biotechs, then focus on those sectors themselves, instead of the index. Small caps are working great. Some aren't going up as much as the large-cap indexes.

But the most important small-caps keep working. And that has helped us continue to buy weakness in equities and bet on sector rotation over the past 18 months or so. The recent bounce in the US Dollar has our attention. Of all the defensive trades, that's been the only one to stop going down.

Now, does the US Dollar have to go up further from here? No. But, if we continue to see further strength in the Dollar, that likely means we are starting to get rotation into other defensive areas like Consumer Staples and Low Volatility stocks.

February is historically the time when that sort of thing happens, and stocks correct further. Remember, the New 52-week highs list peaked on December 14. Short-term weakness after such a historic breadth thrust is perfectly normal.

The question is, how much more weakness do we see? We'll be monitoring all of these closely as we continue to spend the majority of the time looking for stocks to buy.

How about you?

To learn more about JC Parets, please visit AllStarCharts.com.