Geopolitical events have taken a backseat to economic data this week which confirmed US GDP for Q4/2023 grew at 3.3% year-on-year while personal spending increased by 2.8%, states Ian Murphy of MurphyTrading.com.

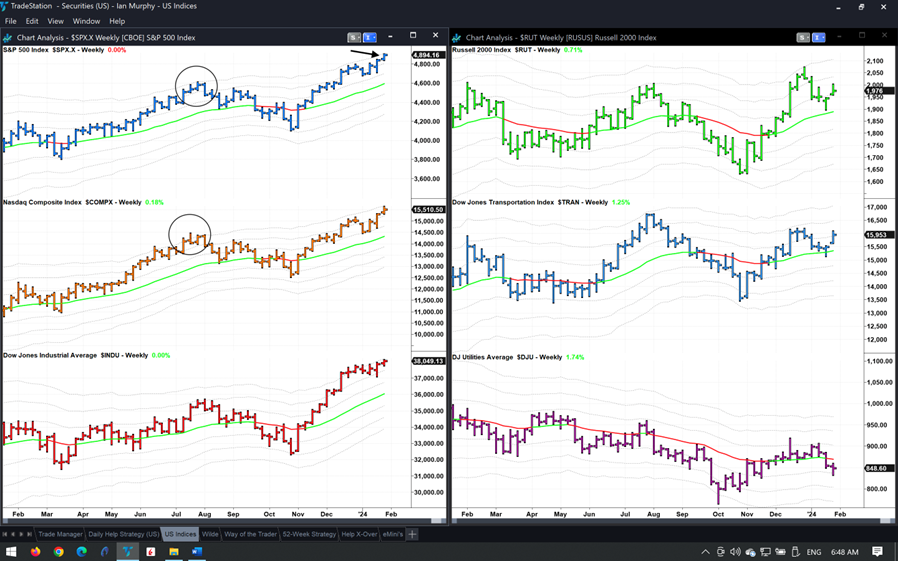

Stock pickers cheerfully embraced the news and drove the S&P 500 (SPX) to yet another all-time high.

The world’s most referenced stock market index is brushing up against its 3ATR channel on a daily chart (arrow), so a pullback of some sort can be expected based on past performance. Individual stocks can breach this level and remain up there for weeks at a time, but indices tend to bump their head on the line and fall back to earth before beginning another rally (circles).

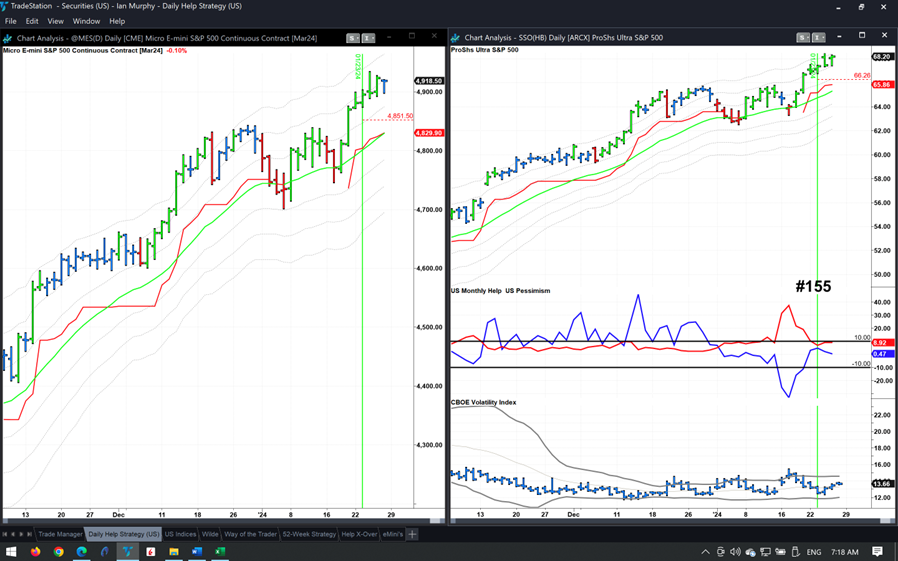

Looking at indices is all well and good, but we are traders and investors, not economists, so we need to know how to capitalize on moves like this, and the Help Strategy stepped up to the plate again when it triggered an entry on Tuesday (Jan 23) as six signals were present for #155.

The initial protective stops for the 2x geared ETF from ProShares (SSO) and Micro E-mini futures are shown above, while the trailing stops are catching up quickly. Both instruments came within a hair’s breadth of their first target on Wednesday but fell short.

Learn more about Ian Murphy at MurphyTrading.com.