The Dow Jones Industrial Average ETF (DIA) triggered a rare monthly buy signal at the close yesterday, January 31, states Larry Tentarelli of the Blue Chip Daily Trend Report.

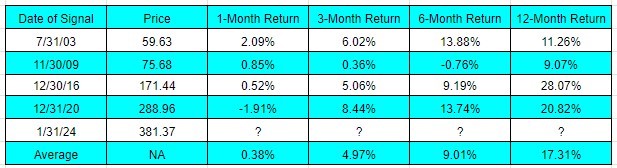

Before the close on 1/31/24, this signal was only triggered four other times since (DIA) started trading, in 1998.

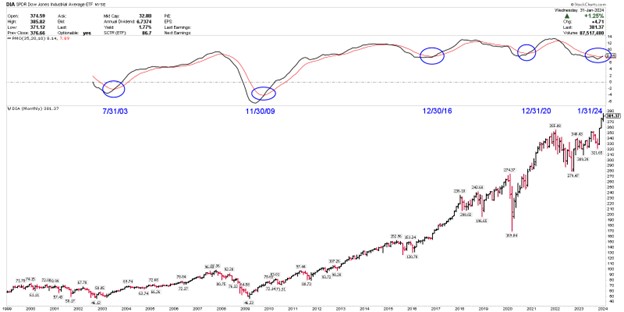

The buy signal is a bullish monthly Price Momentum Oscillator (PMO) cross, after at least two consecutive months with a negative reading. The (PMO) is an oscillator based on a Rate of Change (ROC) calculation that is smoothed twice with exponential moving averages that use a custom smoothing process.

The (PMO) is a slightly slower oscillator than the Moving Average Convergence/Divergence indicator (MACD) and often precedes a major trend move in the direction of the cross.

While 4 signals is not a large sample size, it is the only available data to work with.

Of the four prior occurrences, (DIA) was higher 12 months later, 100% of the time, with an average return of 17.31%, (full data below).

The bullish monthly (PMO) cross, coupled with a monthly base breakout to new all-time highs, are two very strong trend buy signals.

Disclosure: We are holding a long position in (DIA) at the time of this post.

(DIA) MONTHLY, SINCE INCEPTION IN 1998, WITH THE FOUR PRIOR SIGNALS

DISCLAIMER: The information provided in any correspondence, emails, publications, websites, or social media feeds and accompanying material is for informational purposes only. It should not be considered legal or financial advice. The data and information provided are for informational purposes only. The information provided has been obtained from sources deemed reliable but is not guaranteed as to accuracy or completeness. Neither Blue Chip Daily Trend Report, LLC, Larry Tentarelli, nor any of its data or content providers shall be liable for any errors or omissions or any actions taken in reliance thereon. You should consult with a professional Advisor to determine what may be best for your individual needs. Blue Chip Daily Trend Report, LLC, and all affiliates does not make any guarantee or other promise as to any results that may be obtained from using the content. No one should make any investment decision without first consulting his or her financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, ”Company” disclaims any and all liability in the event any information, commentary, analysis, opinions, advice, and/or recommendations prove to be inaccurate, incomplete, or unreliable, or result in any investment or other losses. Full disclaimer: Disclaimer - Blue Chip Daily Trend Report

Learn more about Larry Tentarelli at the Blue Chip Daily Trend Report