For today’s trade of the day we will be looking at a monthly chart for Booz Allen Hamilton Holding Corp. (BAH), states Chuck Hughes of Hughes Optioneering.

Before breaking down BAH’s monthly chart let’s first review what products and services the company offers. Booz Allen Hamilton Holding Corporation is a management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber expertise to the United States and international governments, corporations plus not-for-profit organizations.

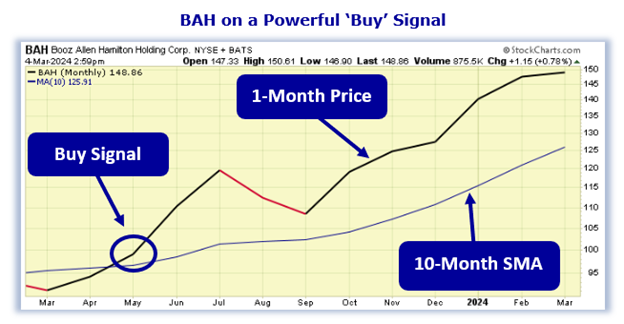

Now, let’s begin to break down the monthly chart for BAH stock. Below is a Ten-Month Simple Moving Average chart for Booz Allen Hamilton Holding Corp.

Buy BAH Stock

As the chart shows, in May, the BAH 1-Month Price, crossed above the 10-Month simple moving average (SMA). This crossover indicated the buying pressure for BAH stock exceeded the selling pressure. For this kind of crossover to occur, a stock has to be in a strong bullish uptrend. As you can see, the one-month Price is still above the 10-Month SMA. That means the bullish trend is still in play! As long as the one-month price remains above the Ten-Month SMA, the stock is more likely to keep trading at new highs and should be purchased. Our initial price target for BAH is 156.50 per share.

101.0% Profit Potential for BAH Option

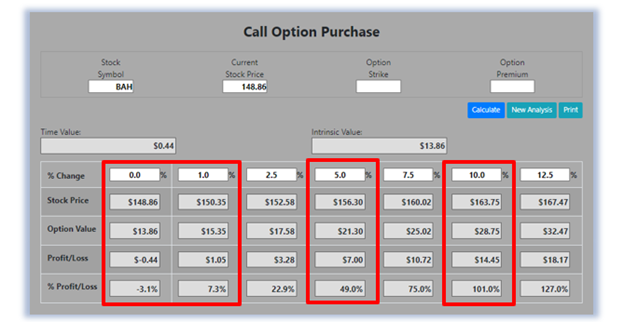

Now, since BAH’s 1-Month Price is trading above the 10-Month SMA this means the stock’s bullish rally will likely continue. Let’s use the Hughes Optioneering calculator to determine the potential returns for a BAH call option purchase. The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat BAH price to a 12.5% increase. The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following BAH option example, we used the 1% Rule to select the BAH option strike price but out of fairness to our paid option service subscribers we don’t list the strike price used in the profit/loss calculation.

Trade with Higher Accuracy

When you use the 1% Rule to select a BAH in-the-money option strike price, BAH stock only has to increase 1% for the option to break even and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying stock closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if BAH stock is flat at 148.86 at option expiration, it will only result in a 3.1% loss for the BAH option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful option trader and can help avoid 100% losses when trading options. The goal of this example is to demonstrate the powerful profit potential available from trading options compared to stocks. The prices and returns represented below were calculated based on the current stock and option pricing for BAH on 3/4/2024 before commissions.

When you purchase a call option, there is no limit on the profit potential of the call if the underlying stock continues to move up in price. For this specific call option, the calculator analysis below reveals if BAH stock increases 5.0% at option expiration to 156.30 (circled), the call option will make 49.0% before commission. If BAH stock increases 10.0% at option expiration to 163.75 (circled), the call option would make 101.0% before the commission and outperform the stock return by more than ten to one.

The leverage provided by call options allows you to maximize potential returns on bullish stocks.