Small-caps are an interesting bunch. When you add up the value of all the stocks in the Russell 2000, it may as well be nothing, states JC Parets of AllStarCharts.com.

There are companies in the United States that alone are worth more than all 2000 companies combined. I think it's important to put things in perspective. These companies don't matter that much. Besides, they always kick out all their best players, by definition.

So, let's not overthink the meaning of small-caps doing well or poorly relative to their large-cap counterparts, who matter. "But JC small-business are very important to the economy." Maybe, but I couldn't care less about your economy. I'm interested in money flow.

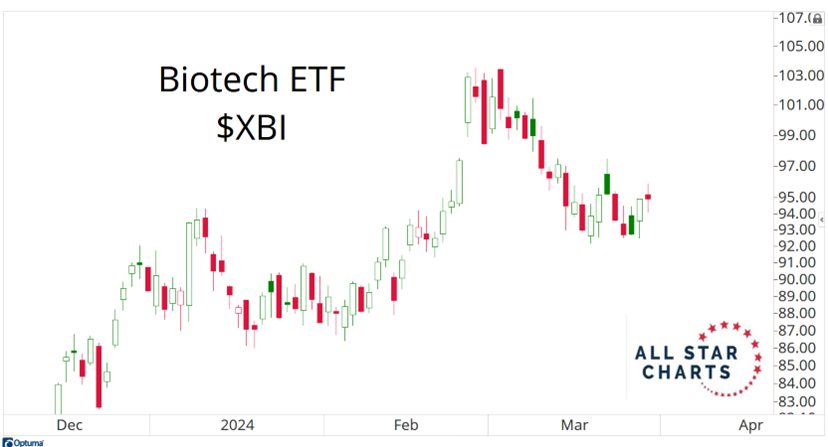

We've seen strength in Small-cap Industrials, Small-cap Materials, and Small-cap Energy. But the rest of the small caps have mostly been a mess. One of the worst areas has been in Small-cap Healthcare. A big reason is because of how many little biotech stocks are included in this group. My favorite trade in Small-caps as we enter Q2 is in Biotechs.

We put on the trade this week, but you can still get in near similar prices. My trade is what we call a "Delta-neutral Credit Spread." Doesn't that sound fancy? Lol, it's not. All it means is that we're taking advantage of just how messy biotech stocks are in this environment. Also, when you look at our entire universe of ETFs, Biotechs have the highest implied volatility.

What that means is that this ETF is the one that's paying us the most. We like that. This is my favorite trade right now in Small-caps as we enter the 2nd Quarter of 2024: Delta-neutral Credit Spread in SPDR Biotech ETF (XBI).

To learn more about JC Parets, please visit AllStarCharts.com.