Using covered call writing exit strategies is an essential skillset needed to achieve the highest possible returns, states Alan Ellman of The Blue Collar Investor.

The calculations for rolling-out-and-up to in-the-money call (ITM) strikes is a bit more complicated than some of our other exit strategies. This article will analyze a real-life example using United Therapeutics Corp., Inc. (UTHR).

What is rolling-out-and-up?

We close the near month ITM call and sell a later-dated, higher strike that is lower than current market value.

When do we consider this exit strategy?

The current strike is ITM and the security still meets our system requirements (including no upcoming earnings reports). The calculations must meet our pre-stated initial time-value return goal, also factoring in share appreciation when rolling.

Real-life trade with UTHR

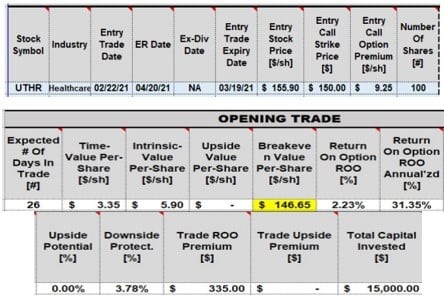

- 2/22/2021: Buy 100 x UTHR at $155.90

- 2/22/2021: STO 1 x 3/19/2021 $150.00 (ITM) call at $9.25

- 3/19/2021: UTHR is trading at $163.22

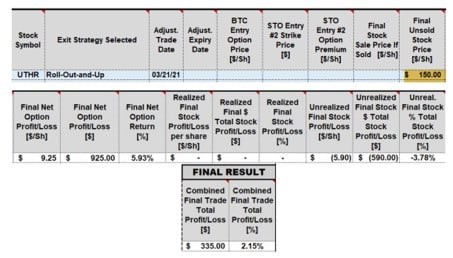

- 3/19/2021: Buy-to-close (BTC) the $150.00 call at $15.50

- 3/19/2021: Sell-to-open (STO) the 4/18/2021 $160.00 call at $9.50

- We have now rolled-out-and-up to an ITM call, as $160.00 is lower than the current market value of $163.22

Initial trade entries and calculations with the BCI Trade Management Calculator (TMC)

- Initial time-value return is 2.23%, 31.35% annualized

- There is 3.78% downside protection of the initial 2.23% profit

Rolling calculations for the current month prior to rolling the option

- Prior to rolling, shares can only be worth $150.00, the ITM strike or our contract obligation to sell

- The final pre-roll return is 2.15% (option credit of 5.93% and a stock debit of 3.78%)

- Final returns are based on the cost of the shares; initial returns are based on the ITM strike price. The rationale is explained in detail in my books & videos and beyond the scope of this article

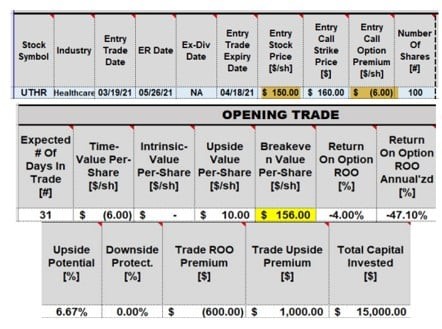

Trade entries and initial calculations of the rolling trade in the next contract cycle (4/18/2021 expiration)

- Value of the stock is $150.00, the previous contract obligation to sell

- There is an option debit of $6.00 ($15.50 – $9.50) or 4.00%

- Shares have an unrealized gain of $10.00 per-share ($160.00 – $150.00) or 6.67%

- The maximum return for the next cycle is 2.67% (6.67% – 4.00%)

Discussion

When rolling-out-and-up to ITM strikes, we close the first contracts using the ITM strike as the final stock value. The same strike is used as the starting stock value for the next contract cycle, factoring in the option credit/debit and the unrealized “bought-up” value of the shares ($150.00 to $160.00, in this example). Rolling-out is almost always to ITM strikes but rolling-out-and-up can be to ITM, ATM or OTM strikes.

Learn more about Alan Ellman on the Blue Collar Investor Website.