Is Goldilocks real? Not if you’re referring to the girl from the 1837 fairy tale. But her economic equivalent just paid a visit to Wall Street – and that scared away more than THREE bears!

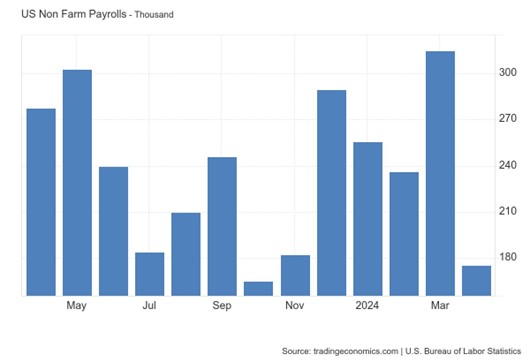

Take a look at this MoneyShow Chart of the Week showing non-farm payroll gains going back a year. Notice that bar on the far right? How the 175,000-job gain in April was much smaller than the ones we’ve seen lately?

That was just what the markets – and the Federal Reserve – were hoping for. It’s a sign labor markets are slackening up a bit. That, in turn, is helping cool wage growth and thereby ease inflation pressures.

Case in point: Average hourly earnings last month rose just 3.9% from a year earlier. That was the smallest annual gain since June 2021. The unemployment rate also ticked up to 3.9%.

After a lousy April for stocks, traders (and investors) were looking for a reprieve. That’s what they got – and it’s just the kind of thing that could lead to a better May in markets.