Back in the early-to-mid-2000s, I was one of the biggest bears on the housing and mortgage markets around. As the crisis spread, I went on to urge investors to dump risky bonds, financial stocks, and many other kinds of risk. Why?

Because of signals coming from the CREDIT markets!

Long before the S&P 500 and the Dow started imploding in 2007-2009, credit spreads started widening. In other words, the extra yield “premiums” borrowers had to pay to raise money in the high-yield (junk) bond market over-and-above the yields on US Treasuries started increasing. At the same time, the cost to buy insurance against bond defaults started rising in the Credit Default Swap (CDS) market.

This was the “Smart Money” sniffing out big trouble. Bond investors, hedge funds, and others were demanding more and more compensation for holding or taking on risk. Eventually, stock investors realized what was going on – and the rest is history.

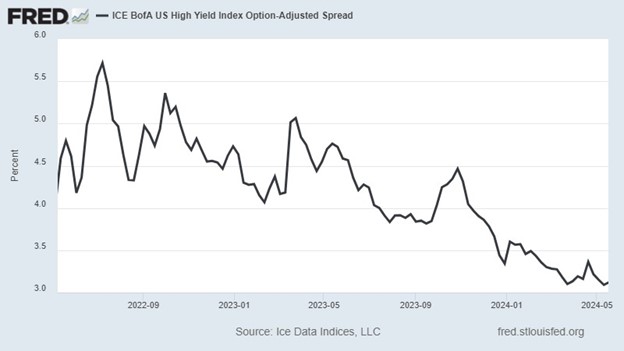

Today? It’s a whole DIFFERENT ballgame! Check out the MoneyShow Chart of the Week. It shows the ICE BofA US High Yield Index Option-Adjusted Spread.

Source: FRED

I know that’s a mouthful! But put simply, it’s a risk spread. Higher means bond investors are more worried about defaults. Lower means they’re less worried.

You can see the trend is pretty clear. Credit concerns have been easing since late-2022. The only exception was the early-2023 spike caused by the rash of bank failures at the time.

In short? The “Smart Money” isn’t worried about hidden or looming risks. And that is one more reason to get (or stay) long stocks, growth commodities, and other “Be Bold” investments!