Kayne Anderson Energy Infrastructure Company (KYN) operates as a closed-end mutual fund company engaged in managing a portfolio of primarily midstream oil and gas companies, asserts Bryan Perry, growth and income expert and editor of Cash Machine.

The fund also holds some utilities and renewable infrastructure energy companies. I like the combination of the three business segments for the $1.1 billion in assets under management. Roughly 84% is invested in midstream stocks with the balance invested evenly among utilities and renewables.

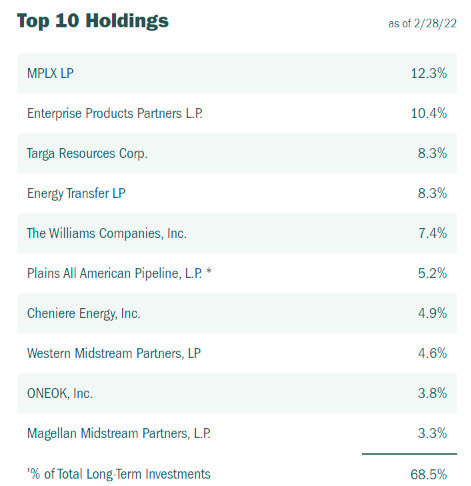

The top 10 holdings make up about 68% of total assets, so it is a fairly well concentrated portfolio of pipeline companies that are enjoying excellent business conditions with oil and gas prices in bullish uptrends.

With the fundamentals currently providing a strong tailwind to energy-related assets, I am fine with a company using some leverage to boost distribution returns.

Per the company’s website, Kayne uses leverage in the form of unsecured notes, preferred stock and revolving bank credit facilities to acquire additional portfolio investments consistent with its investment objective and strategies. Under normal conditions, its policy is to utilize leverage in an amount that represents approximately 25% to 30% of the fund’s total assets.

By flexing some buying power through the use of leverage, Kayne is able to generate a dividend yield of 8.76%. Dividends are paid quarterly with the most recent hike of 14.3% in the quarterly dividend occurring on March 31. Against a backdrop of very strong pricing, I’m looking for further dividend increases in 2022 and 2023.

Distribution History

One of the most attractive features about KYN is that the company generates a 1099 year-end tax form. No K-1 form is issued. K-1 forms almost always create problems for late tax filings and frustrated CPAs. Kayne converts all the MLP income internally and distributes a taxable distribution that is reported just like any common stock dividend.

Shares of KYN are emerging from a year-long basing pattern, reflecting the rapidly improving fundamentals for the oil and gas transmission, storage and processing business.

Since spring is typically a lower demand time of the year, entering the summer driving season and high demand for power by utilities to cool buildings and homes, the way forward for KYN share performance looks promising. Buy Kayne Anderson Energy Infrastructure under $9.50.