Walgreens Boots Alliance (WBA) is the largest retail pharmacy in both the U.S. and Europe. In the short run, the company is facing a headwind from decreasing COVID-19 vaccinations. However, an aging population and a focus on becoming a health destination should help Walgreens grow its bottom line by 4% per year over the next five years, details Ben Reynolds, editor of Sure Dividend.

Through its flagship Walgreens business and other business ventures, the company has a presence in more than nine countries, with more than 13,000 stores in the U.S., Europe, and Latin America. It also has an integrated, diversified healthcare business, including its pharmacy distribution, as well as front-end retail. The company owns the Walgreens and Duane Reade brands, as well as Boots, Benavides, and Ahumada internationally.

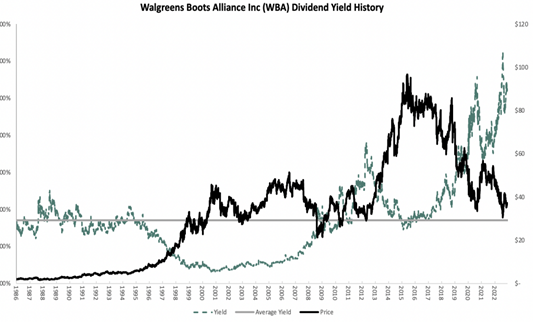

Walgreens was founded in 1901, produces about $135 billion in annual revenue, and trades with a market cap of $32 billion. In addition, Walgreens is close to becoming a Dividend King, with its 47-year streak of dividend increases.

Walgreens reported first-quarter earnings on January 5 and results were somewhat weak. Sales were down 1.5% on an adjusted basis, while earnings-per-share plummeted 31% to $1.16. This was primarily attributable to a sharp reduction in the number of COVID-19 vaccinations the company administered. Adjusted gross margin improved to 22% of revenue, up from 20% in the year-ago period.

Operating income declined, however, as revenue fell. The company noted that its acquisition of Summit Health would be accretive this year, fueling growth. The company reaffirmed 2023 guidance for ~$4.55 in earnings-per-share for this year, implying a roughly 10% decline should that come to fruition.

The primary competitive advantage of Walgreens is its vast scale and network in an important and growing industry. In addition, the company has proven resilient to recessions, as consumers do not reduce their medical expenses even under the most adverse economic conditions. On the other hand, competition has somewhat heated in recent years and thus Walgreens operates with markedly thin operating margins, an issue that is exacerbated when revenue falls.

Walgreens is expected to earn $4.55 per share in 2023. Based on the recent stock price of $37, shares are presently trading at a very low valuation that we think could drive a 4.3% tailwind to annual total returns. When combined with a 4.0% growth rate and the 5.2% dividend yield, expected total returns come to 12.4% per year over the next five years.

Recommended Action: Buy WBA.