Williams-Sonoma Inc. (WSM) is a specialty retailer that operates home furnishing and houseware brands, such as Williams Sonoma, Pottery Barn, West Elm, Rejuvenation, and others. Its competitive advantage lies in its unique product portfolio and successful shift to online sales, advises Ben Reynolds, editor of Sure Dividend.

The company was founded in 1956, produces almost $8.3 billion in annual revenue, and has a current market cap of $8 billion. Williams-Sonoma reported third-quarter earnings on November 17th, 2022 and results were somewhat weaker than expected. The company also pulled its long-term guidance entirely, which spooked investors and sent the stock tumbling.

Revenue came to $2.2 billion during the quarter, which was nearly 7% higher year-over-year, and beat estimates by $40 million. Adjusted earnings-per-share came to $3.72, which was two cents shy of expectations.

The company noted its gross margin rate was 41.5% for the quarter, which was a full 220 basis points lower year-over-year. This sharp decline in profitability was primarily attributable to higher shipping and freight costs. Merchandise margin was flat, and occupancy costs deleveraged 30 basis points as that line item rose 10.5% year-over-year. This outpaced the revenue growth rate.

Management reiterated fiscal 2022 guidance but pulled guidance for 2023 and 2024 that had been previously issued. Still, we forecast $14.20 in earnings-per-share. The company was also resilient to the pandemic. And we praise management for keeping a solid balance sheet, with net debt of only $1.3 billion.

Longer-term, Williams-Sonoma has an impressive growth record. It has grown its earnings-per-share every year in the last decade, at a 22% average annual rate. We think that the retailer has promising growth potential, mostly thanks to its successful shift to online sales.

Based on the recent share price of $125, shares were trading at only 8.8 times projected earnings. This valuation multiple is much lower than the 7-year average of 14.0 for the stock. We expect WSM to revert to its average valuation level over the next five years.

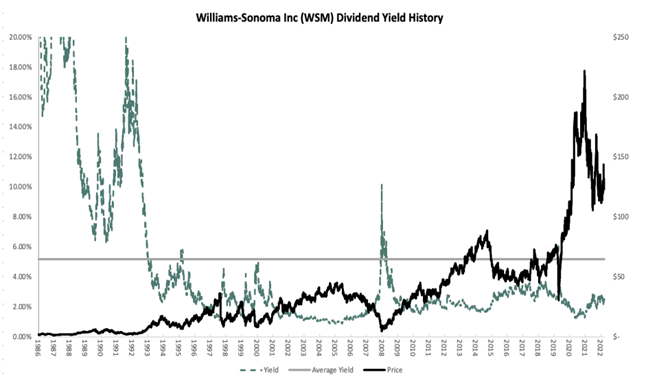

In such a case, the stock would enjoy a 9.8% annualized gain from valuation. When combined with a 3.0% growth rate and the 2.5% dividend yield, expected total returns come to 14.8% per year over the next five years.

Recommended Action: Buy WSM.