We’re going to dig into one of my favorite months of the year – April. The month is home to April Fool’s Day, Tax Day, Earth Day, and my personal favorite holiday, Greek Easter. But none of those are why I’m bullish this month. The reason I’m bullish has to do with one of the strongest long-term trends in the markets, comments Matthew Carr, editor of The First Bar with Matthew Carr.

Awesome April.

That’s what I call it, and you should too. Of course, we all know the weather is warmer this time of year, flowers are in bloom, and spring is in full swing as March’s notorious “Second Winter” fades. But for investors, April provides even more reason to cheer… And that’s because it’s routinely the best month of the year for stocks.

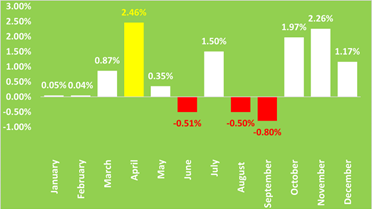

Looking back over the last three decades of monthly returns, the Dow Jones Industrial Average is averaging a 2.46% gain in April.

This is the type of towering bar every investor wants to see. And there’s only one other month even remotely as strong as April: November. April is also the last month of true strength before we nestle ourselves into the annual “Summer Lull” from June through September.

But April’s reputation for solid gains is only one piece of the pie here. The reason April is a truly an awesome month for stocks is that it’s so reliable, unlike Flaky February, Maddening March, Jittery June, or Sloppy September.

You see, successful investing is built on probabilities. If we know the most likely outcome - if we know the trend is with us or against us - we can position ourselves appropriately. And the better chance we have of reaping the rewards of a winning trade.

Well, for the Dow, no other month has a higher probability of success than April. It often doesn’t seem to matter what’s happening at the macro level – a global pandemic, a recession, a crisis in Europe, or a financial collapse - U.S. blue chips tend to push higher in the month. In fact, since 1993, the Dow has only finished April lower seven times. That’s an outstanding 76.67% success rate.

The biggest mistake most investors make is not understanding that stocks - just like seasons – tend to follow predictable trends. And right now, the trend in April is your friend. In fact, one of the friendliest of the year.

So, don’t get fooled into falling for bearish headlines. If you aren’t bullish yet, you should be.