Investors are breathing a sigh of relief, at least for now, after what appears to be some stability being restored in the regional bank sector. This is a good time to scoop up beaten-down, finance-related stocks like Arbor Realty Trust (ABR), advocates Bryan Perry, editor of Cash Machine.

There remains a void of which banks have the same kind of long-term bond exposure and up-to-the-minute data on deposit outflows that caused the chaos, but there is a sense that the worst is over.

Congress is holding a series of hearings on Capitol Hill to get further explanation of how the regulatory bodies (The San Francisco Federal Reserve Bank) failed to properly supervise what now looks in hindsight like a very avoidable situation. But the famous toxic combination of hubris, greed, stupidity and neglect are all coming into focus regarding the bank’s executive committees and those that oversee their activities.

Thankfully, the leadership of these failed banks have been removed, and the Fed is getting its share of cross examination by House and Senate members that will most assuredly result in new and stiffer regulations that will tighten lending standards for both businesses and consumers alike. Bond traders are already betting the Fed will have to pivot this year and lower rates.

This week’s inflation data in the form of the Personal Consumption Expenditures (PCE) index for February, due out Friday morning, is backward looking by a month, but it will have much sway as to the near-term direction for the broad market.

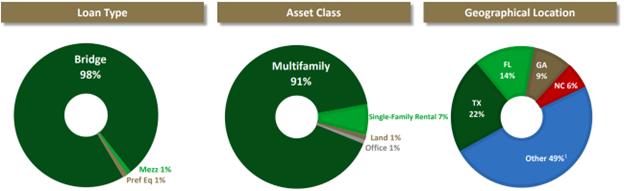

ABR Loan Portfolio Composition (as of 12/31/2022)

The blowoff in the bank sector impacted shares of finance companies like ABR that occupy our model portfolio. In my view, these issues were unfairly punished and should be bought, as the underlying businesses are fundamentally strong.

Arbor Realty invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. It recently yielded 14.3%.

Recommended Action: Buy ABR under $15.50