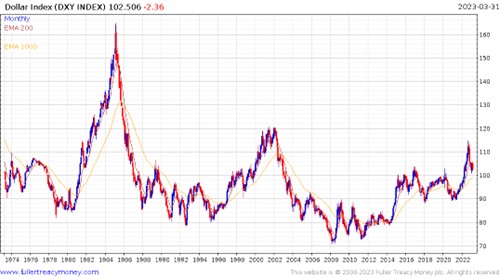

The Dollar Index tends to move in roughly seven-year cycles, with pauses at major turning points. If the secular trend is lower until 2030 that makes several long-term concerns highly relevant – and improves the investment case for the VanEck Vectors Gold Miners ETF (GDX), explains Eoin Treacy, Editor of Fuller Treacy Money.

This is a chart of the Dollar Index (DXY). You can see the pattern I alluded to above:

Down

1969 to 1978 – 9 years

1985 to 1992 – 7 years

1991/2 to 1998 – 7ish years

Up

1978 to 1985 – 7 years.

1995 to 1991/2 – 7ish years after a three-year interval of ranging.

2014 to late 2022 – 8 years after a five-year interval of ranging.

That brings me to the long-term concerns. First is the inadequacy of the U.S.’s discussion about fiscal issues. There are simply too many untouchable topics of conversation in the budget. That makes closing the deficit a major headache. Health care and pensions spending is going to increase markedly over the next decade and there is no plan for how to pay for it.

The unfolding debt issues in the banking sector are a reflection of the stress the system is coming under as a result of the current rate hiking cycle. The stock market is rebounding at present because traders have concluded the financial sector pressure is now high enough to force the Fed to relent. With inflation still way above trend, that’s bad news for the dollar because of the risk of inflation staying at an elevated level for a prolonged period.

The big counter argument at present is the Federal Reserve’s interest rate hiking policy is as much about supporting the Dollar as it is about getting on top of inflation. The U.S. needs to have a stable currency if it is going to encourage foreigners to fund the deficit by buying Treasury bonds.

The Dollar’s cycle argues against that point. The more likely scenario is the Dollar trends lower. I also remain of the view a recession is more likely than not and the greatest risk of a stock market drawdown occurs when the yield curve trends higher into positive territory following an inversion.

While gold is pausing at present, the medium-term outlook is for significantly higher levels in the event the Dollar trends lower.

I increased my investment long in the GDX on November 4, 2022. My original position was purchased in March 2020. I bought another unit in December 2020.

Recommended Action: Buy GDX.