The first Sure Dividend newsletter was published nine years ago, in April of 2014. A lot has happened since then, but the basic idea of owning wonderful businesses at reasonable prices remains as a fundamental investment principle. Lowe’s Cos. (LOW) is a stock that’s currently attractive, writes Ben Reynolds, editor of Sure Dividend.

This is how this concept was described in that first newsletter:

“When you invest in great businesses, it does not matter what the market does. When it is increasing, you are growing your dividends and principal. When the market goes down, you have the opportunity to buy great businesses cheaply. There is no losing situation when you are sure you are investing in the best businesses in the world.”

With that in mind, let’s talk about one of the new names that made our “Top 10” list this month: Lowe’s. It is the second-largest home improvement retailer in the U.S. after Home Depot (HD). The company, which has a current market capitalization of $116 billion, was founded in 1946 and is headquartered in Mooresville, NC.

Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S. and Canada. Lowe’s reported fourth-quarter and full year 2022 results on March 1, 2023. Total sales for the quarter came in at $22.4 billion compared to $21.3 billion in the prior year.

Comparable sales fell 1.5% while the U.S. home improvement comparable sales only declined 0.7%. Adjusted net earnings, which excludes pre-tax transaction costs associated with the sale of the Canadian retail business, improved 28% year-over-year to $2.28 per share.

The company repurchased 10 million shares during the quarter at a cost of $2 billion and distributed $643 million in dividends. For the year, Lowe’s repurchased 71 million shares for $14.1 billion while distributing $2.4 billion in dividends.

Lowe’s has increased its earnings-per-share at rates of 19% over the last decade and 18% over the last five years. We are more conservative in our estimate of 8% growth going forward. Shares of the company are trading at 14 times our forecasted earnings-per-share of $13.75 for 2023. This is below our target price-to-earnings ratio of 19, implying a tailwind from multiple expansion.

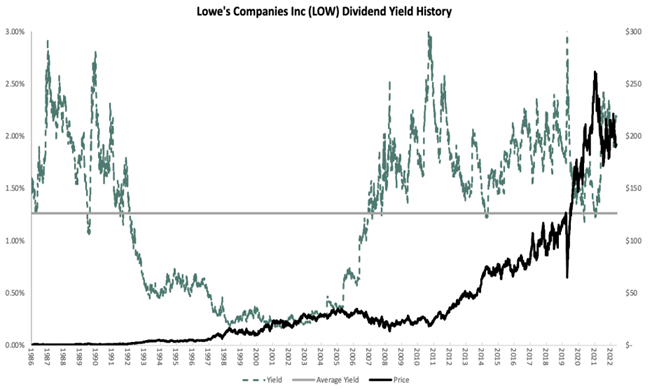

Reaching our target valuation by 2028 would add 6.2% to annual returns over this period. Combined with our expected growth rate of 8% and a starting yield of 2.2%, we project that Lowe’s could provide annual returns of 16.4% through 2028.

Recommended Action: Buy LOW