We think that the Federal Reserve is now in its “pause period,” which has traditionally been favorable for equity prices. Indeed, since 1989, the S&P 500 gained an average of 13% between the last rate hike and the first rate cut, gaining in price in five of six periods, opines Sam Stovall, chief investment strategist of CFRA Research.

The first week of May started with an encouraging sign: JPMorgan Chase (JPM) agreed to purchase First Republic Bank, the troubled regional. Investor focus quickly switched to the FOMC meeting, at which investors received both good and bad news.

The good news was that the post-FOMC statement implied that the Fed issued its final rate hike for this cycle and is now on hold. The bad news is that Fed Chair Powell shared with reporters that FOMC members are not inclined to cut interest rates anytime this year.

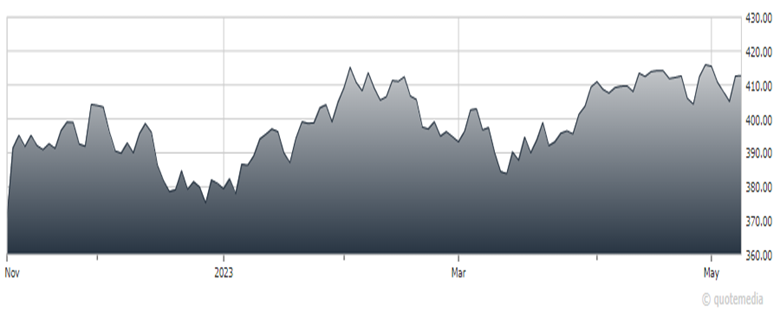

S&P 500 ETF Trust (SPY)

No, the first rate cut might not come until the first quarter of 2024. What’s more, a stabilization in the regional bank space is needed before the markets benefit from an improvement in investor optimism. But history is on the side of the bulls.

Meanwhile, the market action week-to-date through May 4 exemplified investor concerns over rates and regionals, as all sizes, styles, and sectors within the S&P Composite 1500 fell in price, led to the downside by mid-caps, small-caps, as well as value stocks, along with the communication services, energy, and financial sectors.

Not surprisingly, the defensive consumer staples, health care, and utilities groups were relative outperformers. Finally, only 11% of the 153 sub-industries in the S&P 1500 posted advances, led by brewers, construction materials, and gold. The deepest declines were experienced by the broadcasting, housewares & specialties, and regional bank indices.